- Release Date:2025-11-11 08:00:36

- Reading volume: 0

01The definition of vehicle purchase tax and its tax law basis

Vehicle purchase tax is a tax levied on units and individuals who purchase specified vehicles within the territory of the People's Republic of China. Its taxable scope includes all kinds of taxable vehicles such as automobiles, motorcycles, trams, trailers and agricultural transport vehicles.

Its main tax law basis is the "Vehicle Purchase Tax Law of the People's Republic of China", which came into effect on July 1, 2019. At the same time, the "Interim Regulations of the People's Republic of China on Vehicle Purchase Tax" promulgated by The State Council on October 22, 2000 was abolished.

02The scope of collection, taxpayers and collection circumstances of vehicle purchase tax

1.Scope of collection

The taxable scope of vehicle purchase tax includes the following taxable vehicles:The taxable scope of vehicle purchase tax includes the following taxable vehicles:

-Automobile

-Motorcycle

-Tram

-Trailer

-Agricultural transport vehicle

2.Taxpayer

Units and individuals who purchase taxable vehicles within the territory of the People's Republic of China are taxpayers of vehicle purchase tax. Specifically including:

Units and individuals purchasing taxable vehicles

Units and individuals importing taxable vehicles

Units and individuals who produce and use taxable vehicles for their own purposes

Units and individuals that receive taxable vehicles as gifts

Units and individuals who obtain taxable vehicles through awards or other means and use them for their own purposes

3.Examples of situations where vehicle purchase tax needs to be paid:

Individuals purchasing a household car in Guangzhou need to pay the vehicle purchase tax before registering the vehicle

A certain company purchases business vehicles in Shenzhen for business operations and is required to pay vehicle purchase tax

When enterprises import luxury cars from abroad, they need to pay vehicle purchase tax at the import stage

Individuals who purchase motorcycles for daily commuting in Foshan City need to pay vehicle purchase tax

A certain logistics company purchases trailers in Dongguan City for cargo transportation and is required to pay vehicle purchase tax

Individuals who win car prizes through lottery activities need to pay vehicle purchase tax

Enterprises that produce their own vehicles for internal use need to pay vehicle purchase tax

Individuals who receive cars as gifts from relatives or friends need to pay vehicle purchase tax

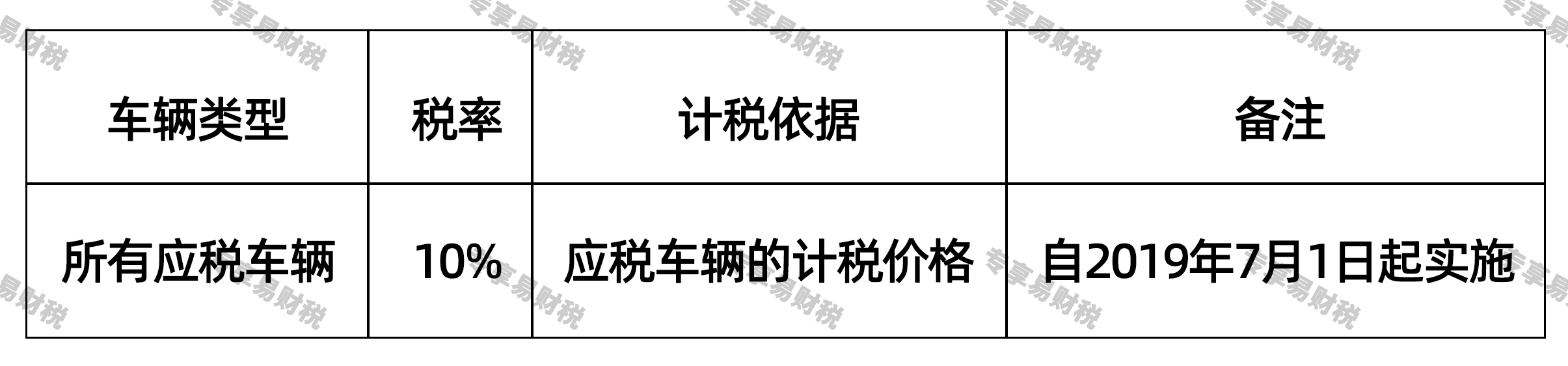

03Several main tax rates for vehicle purchase tax

The vehicle purchase tax is subject to a uniform proportional tax rate. The specific tax rate standards are as follows:

Method for determining the taxable price:

1.Purchase of taxable vehicles for personal use: It refers to the total amount actually paid by the taxpayer to the seller, excluding value-added tax

2.Imported taxable vehicles for self-use: The customs duty value plus customs duty and consumption tax

3.Self-produced and self-used taxable vehicles: Determined based on the sales price of similar taxable vehicles produced by the taxpayer, excluding value-added tax

4.For the acquisition of taxable vehicles for personal use through gifts, awards or other means: The price shall be determined based on the relevant certificates stated at the time of purchase of the taxable vehicle, excluding value-added tax

04Preferential policies on vehicle purchase tax

According to the "Vehicle Purchase Tax Law of the People's Republic of China" and relevant policy regulations, the main tax reduction and exemption benefits include:

Exemption circumstances:

-Vehicles used by foreign embassies, consulates in China and relevant personnel of international organizations in China that are exempt from tax in accordance with the law

-Vehicles included in the equipment ordering plan of the People's Liberation Army of China and the People's Armed Police Force of China

-National integrated fire rescue vehicles with special emergency rescue license plates

-Non-transportation-specific operation vehicles equipped with fixed devices

-Public bus and electric vehicles purchased by urban public transport enterprises

-New energy vehicles (in accordance with relevant national policies and regulations

Circumstances for tax reduction:

-New energy vehicles purchased between January 1, 2024 and December 31, 2025 are exempt from vehicle purchase tax

-For new energy vehicles purchased between January 1, 2026 and December 31, 2027, the vehicle purchase tax will be halved

-Overseas students who return to China to serve and purchase domestic small cars for their own use can be exempted from vehicle purchase tax in accordance with regulations

-Experts who have settled in China for a long time and import small cars for their own use can be exempted from vehicle purchase tax in accordance with regulations

05The proportion of vehicle purchase tax in all tax revenue in China and its significant position in China's fiscal revenue

Vehicle purchase tax is an important tax type in China's tax system and belongs to the central tax. All its income belongs to the central government and it is one of the important sources of national fiscal revenue.

According to the annual fiscal revenue and expenditure data released by the Ministry of Finance of the People's Republic of China, the revenue from vehicle purchase tax has the following characteristics:

-It accounts for a certain proportion of central tax revenue and has been steadily increasing with the expansion of the automotive consumption market

-The scale of revenue is closely related to the prosperity of the automotive sales market and has obvious cyclical characteristics

-The funds are used for specific purposes only, mainly for the construction, maintenance and management of transportation infrastructure such as highways

-It plays a significant role in regulating car consumption and promoting energy conservation and emission reduction

Although the vehicle purchase tax accounts for a relatively small proportion of the total national tax revenue, it holds an important position in supporting the construction of transportation infrastructure, regulating the development of the automotive industry, promoting energy conservation, emission reduction and environmental protection. Especially during the period of rapid development of the automotive industry, vehicle purchase tax provided a stable source of funds for national infrastructure construction.

06Awareness of paying taxes in accordance with the law

Vehicle purchase tax, as an important tax type for the state to regulate car consumption and support the construction of transportation infrastructure, has very strict collection and management policies. Tax authorities ensure the timely and full collection of taxes through measures such as improving the tax collection and management mechanism, strengthening interdepartmental collaboration, and intensifying inspection efforts.

As taxpayers and tax-related professional service institutions, it is essential to deeply understand that paying vehicle purchase tax in accordance with the law is a legal obligation that every unit and individual purchasing taxable vehicles should fulfill. It is necessary to firmly establish the concept of paying taxes in accordance with the law, accurately understand and master the regulations and policies on vehicle purchase tax, and when purchasing taxable vehicles, fulfill the obligation of tax declaration in accordance with the law and pay the tax in full and on time. Guangzhou Exclusive Easy Finance and Taxation Company reminds you: Respecting tax laws and paying taxes in accordance with the law are not only the basic requirements of the law, but also an important manifestation of citizens' social responsibility. Timely payment of vehicle purchase tax not only contributes to the construction of national transportation infrastructure but also creates better travel conditions for oneself, jointly promoting the sustainable development of the economy and society.