Business Management Account

Business Management Account

Export Tax Rebate

Export Tax Rebate

Annual Audit

Annual Audit

Final settlement and payment

Final settlement and payment

Special Audit

Special Audit

off-office Auditing

off-office Auditing

Liquidation Audit

Liquidation Audit

High Tech Audit

High Tech Audit

High Tech Audit

Business Introduction

Business Introduction

High tech audit is based on the "Management Measures for the Recognition of High tech Enterprises", "Guidelines for the Management of the Recognition of High tech Enterprises", and "Special Audit Guidelines for the Recognition of High tech Enterprises by the Chinese Institute of Certified Public Accountants". During the process of applying for high-tech recognition, enterprises need to audit their financial situation, research and development expenses, and income from high-tech products (services) in the past three years, and issue special audit reports and annual audit reports.

High tech audits generally involve five special reports: three annual audit reports for the past three years, one special audit report for high-tech income in the past year, and one special audit report for research and development expenses in the past three years.

Service Items

Service Items

| Service Items | Application scenarios | Notes |

| Special Audit for High Tech Enterprises | Applicable to the recognition of high-tech enterprises | 1. The audit report is issued by Guangzhou Zhengyang Certified Public Accountants (General Partnership); 2. The founder of our company, Yi Shan, is a certified public accountant practicing at the firm. |

Service Mode

Service Mode

On site due diligence+remote preparation

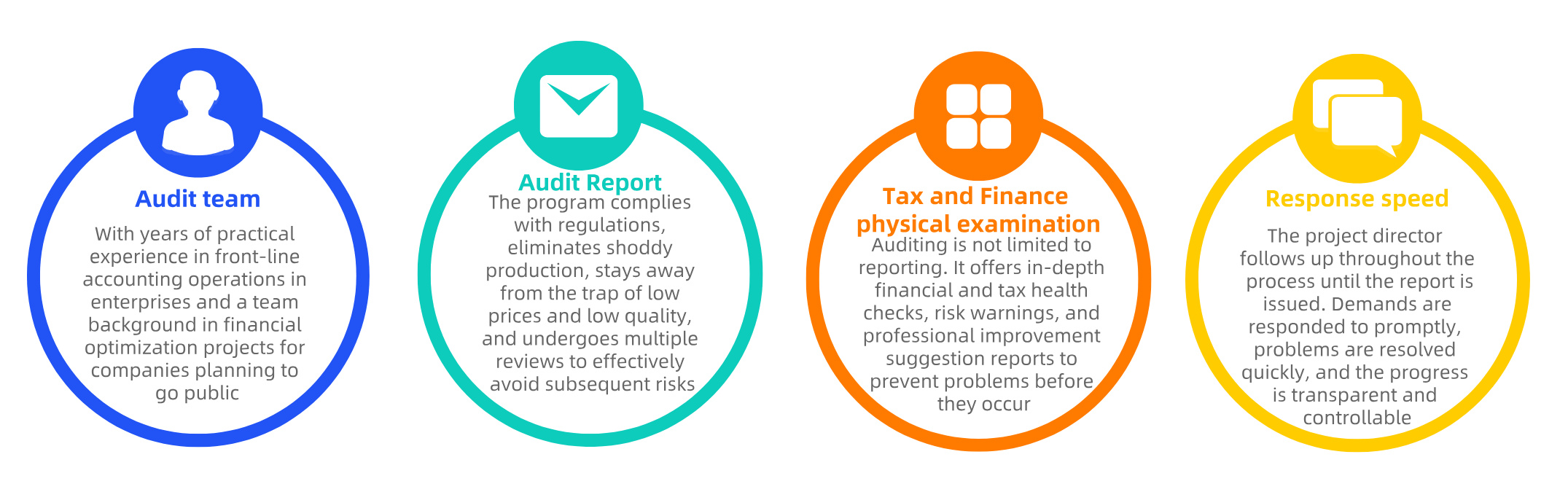

Our Advantages

Our Advantages