- Release Date:2025-11-18 08:00:48

- Reading volume: 0

01The definitions and tax law bases of tonnage tax for ships and purchase tax for vehicles

The tonnage tax on ships is a tax levied on ships entering domestic ports from ports outside the territory of the People's Republic of China, commonly known as the tonnage tax. The tonnage tax on ships is a behavioral tax levied on the use of ports and navigation AIDS by ships.

Its main tax law basis is the "Ship Tonnage Tax Law of the People's Republic of China", which came into effect on July 1, 2018. The tonnage tax on ships is collected and managed by the customs.

02The scope of collection, taxpayers and collection circumstances of vehicle purchase tax

1.Scope of collection

The scope of taxation for tonnage tax on ships includes vessels entering domestic ports from outside the territory of the People's Republic of China. Specifically including:

Merchant ships engaged in international shipping

Foreign ships

International navigation vessels of Chinese nationality

Other vessels that need to pay tonnage tax

2.Taxpayer

The taxpayer of the tonnage tax on ships is the owner or manager of ships entering domestic ports from ports outside the territory of the People's Republic of China. Specifically including

Shipowner

Ship manager

Ship charterer

Other units and individuals who have the right to use ships

3.Examples of situations where tonnage tax on ships needs to be paid:

-A foreign cargo ship entering Guangzhou Port from the port of Singapore to load and unload goods needs to pay the tonnage tax for the vessel

-Chinese-registered international container ships returning from the Port of Los Angeles in the United States to the Port of Shanghai are required to pay the tonnage tax

-Panamanian oil tankers entering Ningbo Port from the Middle East to unload crude oil need to pay the tonnage tax for ships

-Hong Kong-registered passenger ships entering Xiamen Port from Hong Kong are required to pay the tonnage tax

-The cargo ships of China Ocean Shipping Company returning to Tianjin Port from Europe need to pay the tonnage tax

-Foreign cruise ships entering Qingdao Port from Japan for tourism and sightseeing are required to pay the tonnage tax

-Liberian-registered bulk carriers entering Dalian Port from Australia to load goods are required to pay the tonnage tax for ships

03Several main tax rates for tonnage tax on ships

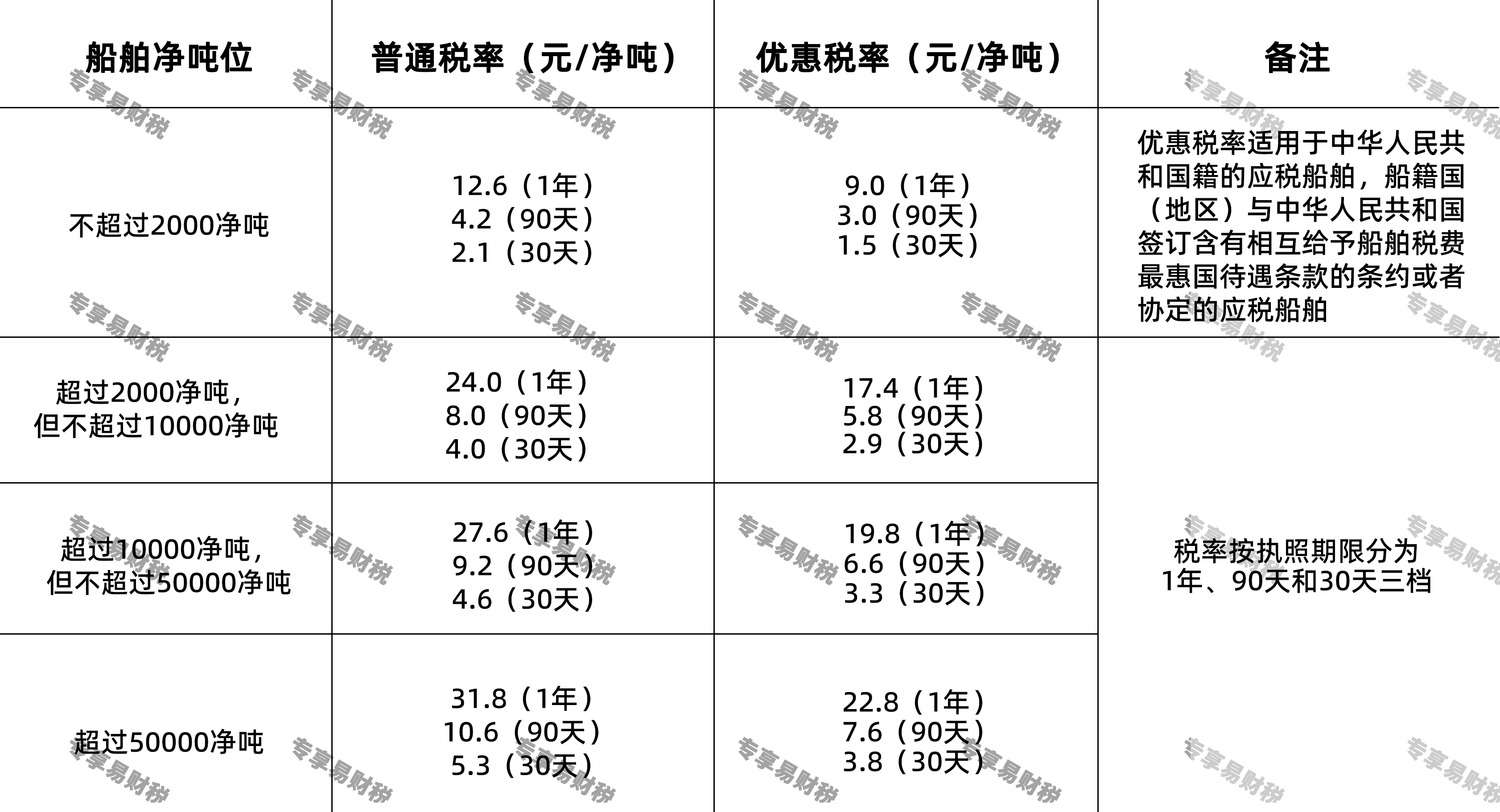

The tonnage tax on ships is subject to a fixed tax rate, with the general tax rate and the preferential tax rate set respectively based on the net tonnage of the ship and the term of the tonnage tax license. The specific tax rate standards are as follows:

04Preferential policies for tonnage tax on ships

According to the "Ship Tonnage Tax Law of the People's Republic of China" and relevant policy regulations, the main tax reduction and exemption benefits include:

Exemption circumstances:

1.Ships with a tax payable of less than 50 yuan

2.Empty vessels that are imported to port for the first time and have obtained ship ownership from abroad through purchase, gift, inheritance or other means

3.Vessels that do not board or disembark passengers or cargo within 24 hours after the expiration of the tonnage tax license

4.Non-motorized vessels (excluding non-motorized barges

5.Fishing and aquaculture vessels

6.Ships that seek refuge, undergo epidemic prevention isolation, are under repair, cease operations or are dismantled without boarding or disembarking passengers or cargo

7.Vessels exclusively used or requisitioned by the military or armed police forces

8.Police vessel

9.Vessels of foreign embassies and consulates in China, representative offices of international organizations in China and relevant personnel that are exempt from tax in accordance with the law

10.Other vessels as prescribed by The State Council

Applicable conditions for preferential tax rates:

1.Taxable vessels registered in the People's Republic of China

2.Taxable vessels whose country (region) of registry has signed treaties or agreements with the People's Republic of China containing provisions for mutual granting of most-favored-nation treatment for vessel taxes and fees

05The proportion of tonnage tax on ships in all tax revenue in China and its significant position in China's fiscal revenue

The tonnage tax on ships is an important tax type in China's tax system and belongs to the central tax. All its income belongs to the central government and is an important component of the national fiscal revenue.

According to the annual fiscal revenue and expenditure data released by the Ministry of Finance and the General Administration of Customs of the People's Republic of China, the tax revenue per ton of ships has the following characteristics:

-It accounts for a relatively small proportion of central tax revenue, but it holds significant strategic importance

-Income scale is closely related to the development of international trade and the shipping industry

-The funds are used for specific purposes only, mainly for the construction and maintenance of port facilities, the management and maintenance of waterways, etc

-It plays a significant role in safeguarding national sovereignty and promoting the development of the shipping industry

Although the tonnage tax on ships accounts for a small proportion of the total national tax revenue, it holds an irreplaceable and significant position in supporting the construction of port infrastructure, maintaining maritime traffic safety, and promoting the development of foreign trade. Especially against the backdrop of China being the world's largest goods trading nation, the tonnage tax on ships has provided a stable source of funds for the construction of national ports and waterways.

06Awareness of paying taxes in accordance with the law

As an important tax type for the state to maintain port facilities and promote shipping development, the tonnage tax on ships has very strict collection and management policies. The customs ensures the timely and full collection of taxes through measures such as improving the tax collection and administration mechanism, strengthening ship supervision, and intensifying inspection efforts.

As taxpayers and tax-related professional service institutions, it is essential to deeply understand that paying the tonnage tax of ships in accordance with the law is a legal obligation that every ship owner or manager should fulfill. It is necessary to firmly establish the awareness of national sovereignty and the concept of tax rule of law, accurately understand and master the laws and policies on tonnage tax for ships, and fulfill the obligation of tax declaration in accordance with the law when ships enter Chinese ports, and pay the taxes in full and on time. Guangzhou Exclusive Easy Finance and Taxation Company reminds you: Respecting tax laws and paying taxes in accordance with the law is not only a basic requirement of the law, but also an important guarantee for safeguarding national sovereignty and promoting the healthy development of the shipping industry. Timely payment of tonnage tax for ships not only contributes to the construction of national port infrastructure but also creates a better shipping environment for oneself, jointly promoting the prosperous development of China's shipping industry and foreign trade.