Business Management Account

Business Management Account

Export Tax Rebate

Export Tax Rebate

Annual Audit

Annual Audit

Final settlement and payment

Final settlement and payment

Special Audit

Special Audit

off-office Auditing

off-office Auditing

Liquidation Audit

Liquidation Audit

High Tech Audit

High Tech Audit

Liquidation Audit

Business Introduction

Business Introduction

Liquidation audit refers to the audit of a company's debt and credit settlement, asset realization, as well as its income, losses, and expenses during the liquidation period due to various reasons.

Usually includes contract expiration liquidation audit; Industrial adjustment liquidation audit; Unable to continue operating liquidation audit; Audit of illegal business liquidation; Corporate merger and liquidation audit; Enterprise bankruptcy liquidation audit.

The liquidation audit report issued is mainly used by tax authorities for tax clearance of enterprises, before issuing tax payment certificates, and by industrial and commercial departments for deregistration of enterprises.

Service Items

Service Items

| Service Items | Application scenarios | Notes |

| Cancel liquidation audit report | Tax compliance, safeguarding shareholder rights and interests, and tax deregistration and clearance basis | 1. The audit report is issued by Guangzhou Zhengyang Certified Public Accountants (General Partnership); 2. The founder of our company, Yi Shan, is a certified public accountant practicing at the firm. |

Service Mode

Service Mode

On site due diligence+remote preparation

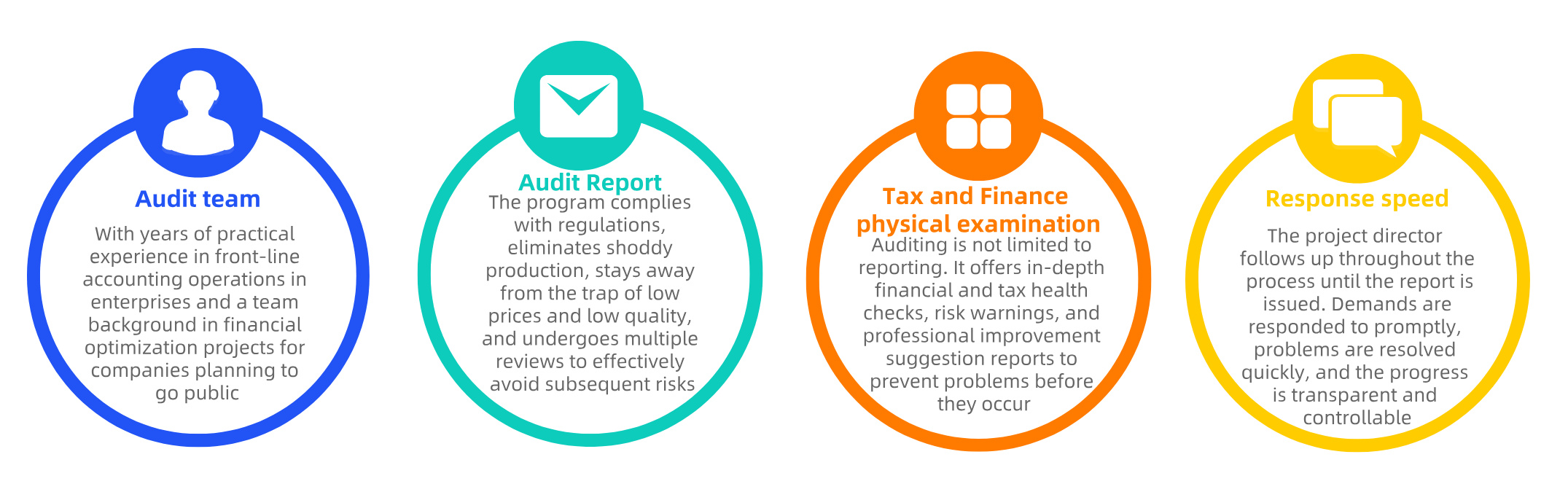

Our Advantages

Our Advantages