- Release Date:2025-09-30 08:00:49

- Reading volume: 0

01The definition of land value-added tax and its tax law basis

Land value-added tax is a tax levied on units and individuals who transfer the right to use state-owned land, buildings on the land and their attachments (referred to as the transfer of real estate) and obtain income, based on the value-added amount they obtain from the transfer of real estate.

Its main tax law basis is the "Provisional Regulations of the People's Republic of China on Land Value-Added Tax" (State Council Decree No. 138) promulgated by The State Council on December 13, 1993, and the "Detailed Rules for the Implementation of the Provisional Regulations of the People's Republic of China on Land Value-Added Tax" (CAI Fa Zi [1995] No. 6) issued by the Ministry of Finance.

02The scope of land value-added tax collection, taxpayers and applicable tax rates

Scope of taxation:

Transfer the right to use state-owned land.

The buildings on the ground and their attachments shall be transferred together with the right to use the state-owned land.

Taxpayer:

Units and individuals who transfer the right to use state-owned land, buildings on the land and their attachments (hereinafter referred to as the transfer of real estate) and obtain income are taxpayers of land value-added tax.

Tax base (calculation of tax payable) :

Land value-added tax is calculated and levied based on the value-added amount obtained by the taxpayer from the transfer of real estate and the prescribed tax rate. The calculation formula for the value-added amount is:

The value-added amount = the income obtained from the transfer of real estate - the amount of items deducted

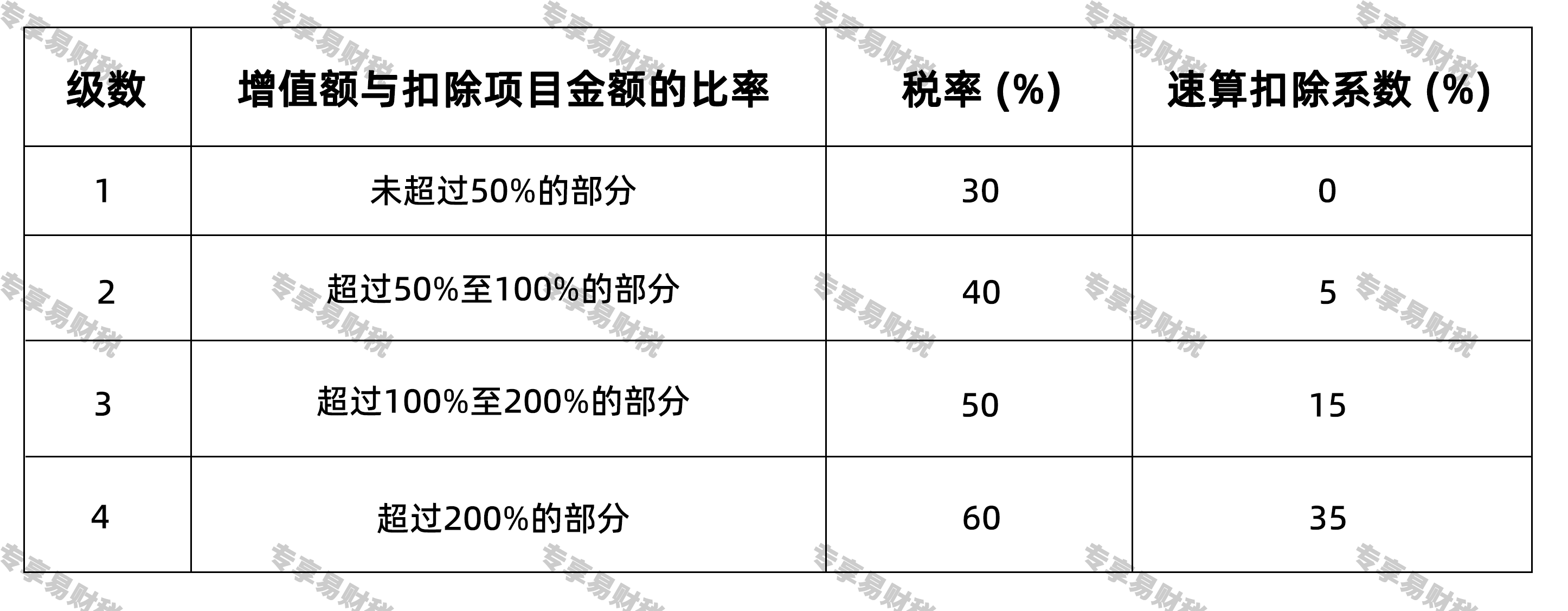

Tax payable = Value-added amount × applicable tax rate - deductible item amount × quick deduction coefficient

03Tax reduction and exemption benefits

According to current regulations, the main tax reduction and exemption benefits include but are not limited to:

1.Taxpayers who build ordinary standard residences and sell them, if the value-added amount does not exceed 20% of the deductible item amount, are exempt from land value-added tax.

2.Real estate that is lawfully expropriated or reclaimed for the needs of national construction is exempt from land value-added tax.

3.Individuals selling housing are temporarily exempt from land value-added tax (specific policies are subject to local regulations).

4.When real estate is used for investment or joint venture, and one party of the investment or joint venture uses the land (real estate) as equity for investment or as a condition for joint venture, and transfers the real estate to the invested or joint venture enterprise, the land value-added tax is temporarily exempted (Note: This policy has been adjusted before, please pay attention to the latest regulations).

04The main tax rates of land value-added tax

The land value-added tax implements a four-level progressive tax rate exceeding the rate:

05The proportion of land value-added tax in all taxes in China and its significant position in China's fiscal revenue

Land value-added tax is an important tax type in China's tax system and is a local tax. All its income belongs to the local government and it is one of the important sources of local fiscal revenue.

In recent years, with the rapid development of China's real estate market, the revenue from land value-added tax has increased significantly. According to the annual fiscal revenue and expenditure situation released by the Ministry of Finance of the People's Republic of China, although the proportion of land value-added tax revenue in the total national tax revenue is relatively small (usually at a few percent), it plays an important role in regulating the real estate market, increasing local government fiscal revenue, and adjusting the distribution of land income. Especially in some cities with active real estate markets, the contribution of land value-added tax to local financial resources is more prominent.

06Awareness of paying taxes in accordance with the law

Land value-added tax, as an important tool for the state to regulate the real estate market and participate in the distribution of land value-added income, has strict collection and management policies. Tax authorities ensure that taxes are deposited in full and on time through measures such as strengthening project management, improving the settlement system, and intensifying inspection efforts.

As taxpayers and tax-related professional service institutions, it is essential to deeply understand that paying taxes in accordance with the law is the obligation that every citizen and enterprise should fulfill. It is necessary to firmly establish the concept of tax rule of law, accurately understand and master the laws and policies of land value-added tax, and in real estate transactions and development activities, fulfill the obligation of tax declaration in accordance with the law to ensure the accuracy of calculation and the timeliness of tax payment. Guangzhou Exclusive Easy Finance and Taxation Company reminds you: Respecting tax laws and paying taxes in accordance with the law is not only a legal requirement but also a manifestation of corporate social responsibility, which is conducive to maintaining a healthy market economic order and the long-term development of enterprises.