- Release Date:2025-09-23 08:00:23

- Reading volume: 0

01The definition of resource tax and its tax law basis

Resource tax is a type of tax levied on various taxable natural resources to regulate the income from resource grade differences and reflect the paid use of state-owned resources. Resource tax can theoretically be divided into general resource tax levied on absolute ore rent and differential resource tax levied on differential ore rent. In terms of tax policy, it is called "universal collection and differential adjustment".

The main legal basis for China's resource tax is the "Resource Tax Law of the People's Republic of China" passed at the 12th meeting of the Standing Committee of the 13th National People's Congress on August 26, 2019. This law came into effect on September 1, 2020. Meanwhile, the "Announcement of the Ministry of Finance and the State Taxation Administration on the Implementation Standards of Certain Issues Concerning Resource Tax" (Announcement No. 34 of 2020) and other supporting documents have also made specific provisions on the collection and management of resource tax.

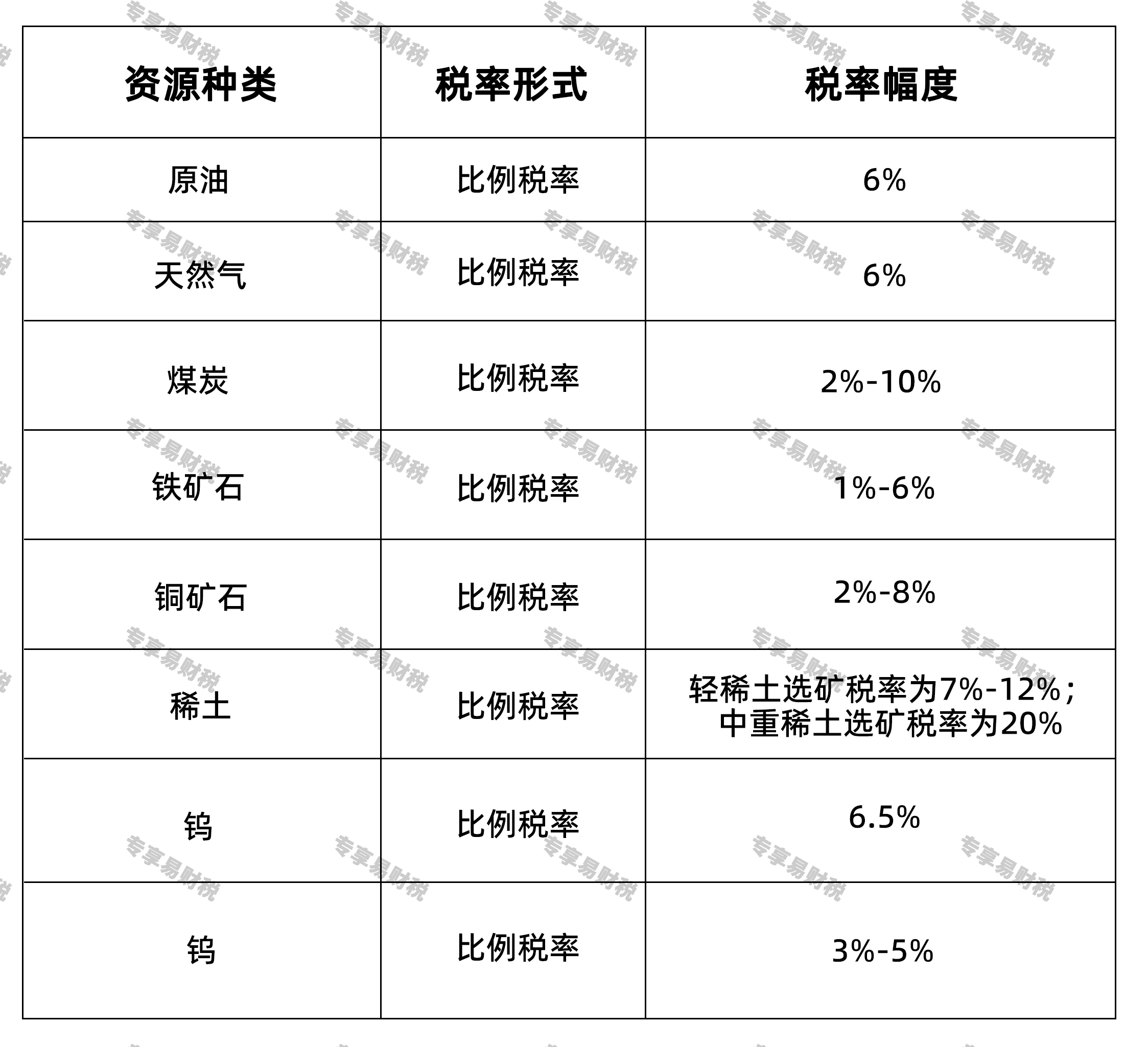

It should be noted that the specific applicable tax rates may vary in different regions. When paying taxes, the standards announced by the local tax authorities should be taken as the standard.

Resource tax is a local tax type in China's tax system. Although it accounts for a relatively small proportion of the country's total tax revenue (usually about 1% to 2%), it is of great significance to the local finance of resource-rich regions.

According to the data released by the State Taxation Administration, the national resource tax revenue in 2022 was approximately 300 billion yuan, accounting for about 1.5% of the total national tax revenue. Although the proportion is not high, the resource tax plays an irreplaceable role in regulating the differential income of resources, promoting the conservation and intensive use of resources, and protecting the ecological environment.

For resource-rich regions such as Shanxi, Inner Mongolia, Shaanxi and Xinjiang, resource tax is an important source of local fiscal revenue, and in some counties and cities, it even accounts for more than 30% of the local fiscal revenue. The reform and improvement of resource tax is of great significance for promoting coordinated regional development and supporting the economic transformation of resource-based regions.

06Respect tax laws and have the awareness of paying taxes in accordance with the law

As an important tax type in China's tax system, the state has very strict collection and management over resource tax. Taxpayers should enhance their awareness of tax law compliance and fulfill their tax obligations in accordance with the law.

1.Study the resource tax law and related regulations and policies carefully, and understand your own tax obligations and rights.

2.Establish and improve financial and tax management systems, and accurately calculate the sales revenue and volume of taxable products.

3.Make tax returns on time, truthfully submit tax-related materials, and do not make false, concealed or omitted reports.

4.Properly keep the contracts, invoices, vouchers and other materials related to the mining and sale of taxable products.

5.Actively cooperate with the tax authorities in tax inspections and work guidance, and promptly correct any problems existing in the tax payment process.

Paying taxes in accordance with the law is a legal obligation of every citizen and enterprise, and it is also a manifestation of corporate social responsibility. Only by voluntarily abiding by tax laws can a fair and competitive market economy environment be created and sustainable economic and social development be promoted. Guangzhou Exclusive Easy Finance and Taxation Company reminds all taxpayers to firmly establish the awareness of paying taxes in accordance with the law and avoid bearing legal responsibilities and economic losses due to tax violations.