- Release Date:2025-10-14 08:00:00

- Reading volume: 0

01The definition of urban land use tax and its tax law basis

Urban land use tax is a tax levied on units and individuals who own the right to use land within the scope of cities, county seats, established towns and industrial and mining areas, with the actual occupied land area as the tax basis, at the prescribed tax rate.

Its main tax law basis is the "Interim Regulations of the People's Republic of China on Urban Land Use Tax" (State Council Decree No. 483) revised and promulgated by The State Council on December 31, 2006, as well as the detailed implementation rules formulated by the people's governments of all provinces, autonomous regions and municipalities directly under the Central Government.

02The scope of collection, taxpayers and collection circumstances of urban land use tax

Scope of collection:

The scope of collection of urban land use tax includes cities, county seats, established towns and industrial and mining areas. The specific scope of taxation shall be demarcated by the people's governments of the provinces, autonomous regions and municipalities directly under the Central Government.

Taxpayer:

Units and individuals that use land within the scope of cities, county seats, established towns and industrial and mining areas are taxpayers of urban land use tax. Specifically including:

Units and individuals who own the right to use land

Where the right to use land has not been determined or the dispute over its ownership has not been resolved, the actual user shall pay the tax

Where the right to use land is jointly owned, each co-owner shall pay taxes respectively

Where land is leased out, the lessor shall pay taxes

Examples of situations where urban land use tax needs to be paid:

A certain company has office land in Tianhe District, Guangzhou City and is required to pay the urban land use tax on an annual basis

A certain manufacturing enterprise has built a factory in an industrial zone of Dongguan City and is required to pay the urban land use tax for the industrial land it occupies

A certain real estate development enterprise is developing a commercial housing project on a certain plot in Foshan City. During the construction period, it needs to pay the urban land use tax for the project land

If a shopping mall leases a commercial area in Shenzhen for operation and the lease contract stipulates that the lessee shall bear the land use tax, then the shopping mall needs to pay this tax

A certain enterprise has the right to use land in an industrial park but it is temporarily idle and undeveloped, and still needs to pay the urban land use tax

03The main tax rates of urban land use tax

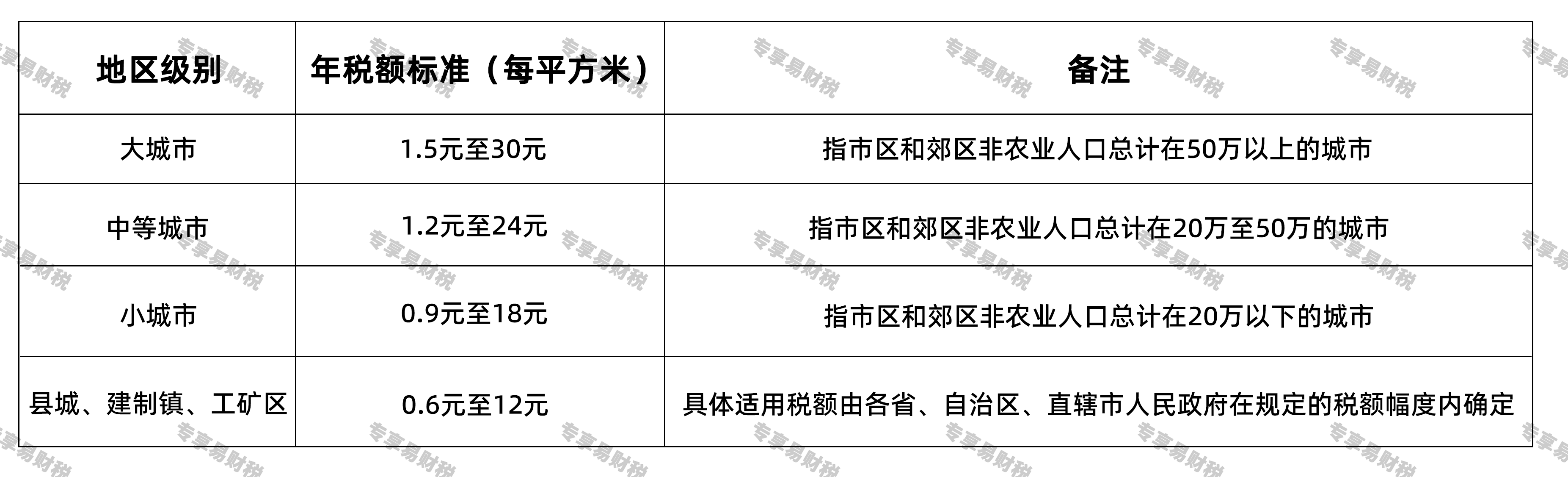

The urban land use tax adopts a fixed tax rate, that is, a differential tax rate with a range is used. The annual tax payable per square meter of land use tax is respectively stipulated for large, medium and small cities, county seats, established towns and industrial and mining areas. The specific standards are as follows:

Note: The people's governments of provinces, autonomous regions and municipalities directly under the Central Government may, based on conditions such as the status of municipal construction and the degree of economic prosperity, determine the applicable tax rate range for their respective regions within the prescribed tax rate range.

04Preferential policies for urban land use tax

According to current regulations, the main tax reduction and exemption benefits include but are not limited to:

1.Land used by state organs, people's organizations and the military for their own purposes

2.Land used by units funded by the state's financial department for their own purposes

3.Land used by religious temples, parks and historical sites for their own purposes

4.Public land such as municipal streets, squares and green belts

5.Production land directly used for agriculture, forestry, animal husbandry and fishery

6.Land that has been approved for mountain reclamation and sea reclamation and abandoned land that has been transformed will be exempt from land use tax for five to ten years starting from the month of use

7.Land for energy, transportation, water conservancy facilities and other uses that are exempt from tax as separately stipulated by the Ministry of Finance

8.The land for residential houses and courtyards owned by individuals shall be reduced or exempted by the tax bureaus of each province, autonomous region and municipality directly under the Central Government

9.The land for low-rent housing and affordable housing construction, as well as the land for low-rent housing leased by low-rent housing management units to the designated beneficiaries at the government-prescribed prices, is exempt from urban land use tax

05The proportion of urban land use tax in all taxes in China and its significant position in China's fiscal revenue

Urban land use tax is an important tax type in China's tax system and belongs to local taxes. All its income belongs to the local government and it is one of the important sources of local fiscal revenue.

According to the historical fiscal revenue and expenditure data released by the Ministry of Finance of the People's Republic of China, the proportion of urban land use tax revenue in the total national tax revenue has remained relatively stable. Although it is not the highest proportion, it holds special significance for local governments.

It has provided a stable source of fiscal revenue for local governments

Promote the rational allocation and economical and intensive utilization of land resources

Regulate the differential income of land and promote fair competition among enterprises

Strengthen land management and protect the legitimate rights and interests of land users

Especially in economically developed regions and urban central areas, due to the high value of land, the contribution of urban land use tax to local finances is more significant.

06Awareness of paying taxes in accordance with the law

Urban land use tax, as an important tax type for the state to regulate the allocation of land resources and increase local fiscal revenue, has strict collection and management policies. Tax authorities ensure that tax revenues are promptly and fully deposited into the Treasury through measures such as strengthening the management of land registration information, improving the tax collection and administration mechanism, and intensifying inspection efforts.

As taxpayers and tax-related professional service institutions, it is essential to deeply understand that paying taxes in accordance with the law is the obligation that every citizen and enterprise should fulfill. It is necessary to firmly establish the concept of tax rule of law, accurately understand and master the laws, regulations and policies of urban land use tax, and fulfill the obligation of tax declaration in accordance with the law in land use and business activities, ensuring the accuracy of calculation and the timeliness of tax payment. Guangzhou Exclusive Easy Finance and Taxation Company reminds you: Respecting tax laws and paying taxes in accordance with the law is not only a legal requirement but also a manifestation of corporate social responsibility. It helps maintain a healthy market economic order and the long-term development of enterprises. At the same time, it is also conducive to promoting the rational utilization of land resources and the sustainable development of cities.