- Release Date:2025-09-02 08:00:52

- Reading volume: 0

Zhuanxiang Yi Finance & Taxation provides a comprehensive analysis of property tax to help enterprises operate in a lawful and compliant manner while fully benefiting from tax incentives. Zhuanxiang Yi Finance & Taxation helps you avoid hidden pitfalls! We assist entrepreneurs in conducting operations compliantly and mastering essential financial and tax survival guides—saving money while staying compliant!

01 Definition of Property Tax and Legal Basis

Property tax is a type of property tax levied on the owner of the property right, with houses as the taxable object and the taxable residual value of the house or rental income as the tax base. The current property tax was introduced after the second round of the reform of converting profits into taxes. On September 15, 1986, the State Council officially issued the Interim Regulations of the People's Republic of China on Property Tax, which came into effect on October 1, 1986.

The legal basis for property tax mainly includes: the Interim Regulations of the People's Republic of China on Property Tax, the interpretations and interim provisions on several specific issues of property tax issued by the Ministry of Finance and the State Taxation Administration, and the implementation rules formulated by local governments.

02 Taxable Objects and Taxpayers of Property Tax

Property tax is mainly levied on operational properties, including properties owned by enterprises and properties used by individuals for business purposes. Specifically:

The taxable scope of property tax covers cities, county seats, established towns and industrial and mining areas, excluding rural areas.

Examples of situations requiring property tax payment:

•Self-used office buildings, factories, shops, etc. owned by enterprises;

•Individuals using their own properties for rental to obtain rental income;

•Unsold vacant commercial housing built by developers;

•Properties of business premises such as hotels and guesthouses.

Taxpayers of property tax:

•Owners of property rights;

•Operation and management units;

•Pledges;

•Property custodians or users.

It should be noted that individual self-occupied housing is currently exempt from property tax, but once used for business or rental purposes, property tax must be paid in accordance with regulations.

03 Several Main Tax Rates of Property Tax

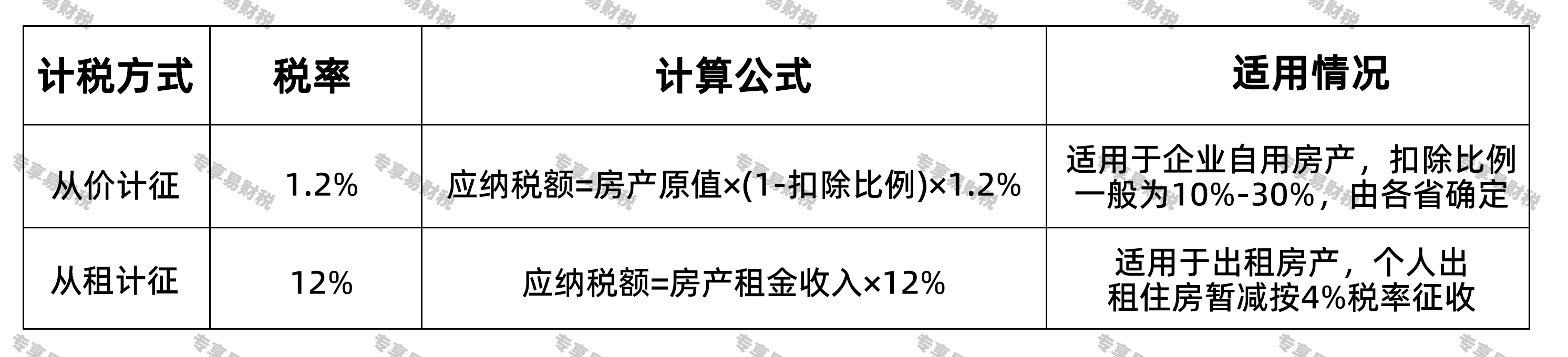

China's property tax adopts a proportional tax rate, which is divided into two types according to different tax bases:

It should be noted that different regions may adjust the tax rate according to actual conditions, and the specific implementation shall be based on local policies.

04 Preferential Policies for Property Tax

I. Basic Tax Exemption Policies

•Properties for self-use by state organs, people's organizations, and military units: Exempt from property tax.

•Properties for self-use by units funded by financial appropriations: Properties for self-use by units funded by financial appropriations from the national finance department are exempt, except for self-financing public institutions.

•Properties for self-use by religious sites, parks, and scenic spots: Properties for self-use by religious temples, parks, and scenic spots are exempt.

•Non-operational properties owned by individuals: Non-operational properties owned by individuals are exempt, but properties used for rental or business purposes are subject to tax.

II. Special Tax Exemption Policies

•Properties for self-use by schools, hospitals, etc. run by enterprises: Properties for self-use by schools, hospitals, nurseries, and kindergartens run by enterprises are exempt from property tax.

•Damaged or dangerous houses: Damaged houses that are uninhabitable or dangerous houses that have been identified and stopped from use are exempt from property tax.

•Temporary houses for infrastructure construction: Temporary houses such as work sheds and material sheds at infrastructure construction sites are exempt during the construction period; if they are returned or transferred to the infrastructure unit after the project is completed, property tax shall be levied from the next month of acceptance.

•Houses under major repair and out of use: If a house is out of use for more than half a year due to major repair, it is exempt from property tax during the repair period.

•Properties for self-use by elderly care service institutions: Temporarily exempt from property tax.

•Public rental housing and low-rent housing: Public housing and low-rent housing rented at government-specified prices, as well as rental income from operating public rental housing, are exempt from property tax.

•Student apartments in colleges and universities: Exempt from property tax; the policy is valid until December 31, 2027.

•Agricultural product wholesale markets and farmers' markets: Properties specifically used for the operation of agricultural products are temporarily exempt from property tax; for properties used for both agricultural products and other products, tax exemption or levy shall be determined based on the proportion.

•Heating enterprises in the "Three North" regions (Northeast, North China, and Northwest China): Factories used for heating residents are exempt from property tax; the policy is valid until the end of the 2027 heating season.

•Commodity reserve management companies and their directly affiliated warehouses: Properties for self-use that undertake commodity reserve business are exempt from property tax; the policy is valid until December 31, 2027.

•Community elderly care, child care, and domestic service institutions: Properties obtained for self-use or through leasing, free use, etc., and used for providing community elderly care, child care, and domestic service are exempt from property tax; the policy is valid until December 31, 2025.

•R&D projects for large civil aircraft, etc.: Properties for self-use in scientific research, production, and office work by taxpayers and their wholly-owned subsidiaries engaged in R&D projects of large civil aircraft engines, medium and high-power civil turboshaft and turboprop engines, and civil aircraft with an empty weight of more than 45 tons are exempt from property tax; the policy is valid until December 31, 2027.

•Operation and management units of drinking water projects: Properties for self-use in production and office work are exempt from property tax; the policy is valid until December 31, 2027.

•National and provincial-level technology business incubators, etc.: Properties for self-use and properties provided to incubated entities for free or through leasing are exempt from property tax; the policy is valid until December 31, 2027.

III. Halved Tax Collection Policy

From January 1, 2023 to December 31, 2027, property tax shall be levied at a 50% reduction for small-scale VAT taxpayers, small and micro-profit enterprises, and individual industrial and commercial households, which can be enjoyed in combination with other preferential policies.

IV. Other Preferential Policies

•Individual rental housing: Property tax shall be levied at a rate of 4%.

•Rental housing by enterprises and public institutions: When renting housing to individuals and professional large-scale housing rental enterprises, property tax shall be levied at a reduced rate of 4%; the policy shall apply mutatis mutandis to the rental of indemnificatory rental housing.

The above policies integrate national-level universal preferences and some local policies, and the specific implementation shall be based on the provisions of the local tax authorities. It is recommended to consult the local tax authorities in combination with actual conditions to ensure the accurate enjoyment of preferential policies.

05 Proportion of Property Tax in China's Total Tax Revenue and Its Important Status in China's Fiscal Revenue

Property tax is an important part of China's local tax system. According to data from the State Taxation Administration, in recent years, property tax has accounted for approximately 1.5% to 2% of the national total tax revenue. Although the proportion is not high, it is a stable source of fiscal revenue for local governments.

From the perspective of local finance, property tax can account for more than 5% of tax revenue in some regions, making it one of the important pillars of the local tax system. With the continuous development of the real estate market and the improvement of the tax system, the status of property tax in fiscal revenue is expected to be further enhanced.

In the future, with the advancement of real estate tax legislation and reform, property tax may gradually become the main tax category for local governments, providing a more stable and sustainable source of fiscal revenue for local governments and reducing reliance on land finance.

06 Awareness of Paying Taxes in Accordance with the Law

As an important national tax category, property tax has strict collection policies. Taxpayers should develop the awareness of respecting tax laws and paying taxes in accordance with the law:

•Declare property tax on time, without late declaration or under-declaration;

•Truthfully provide property-related information, without concealment or false reporting;

•Pay taxes within the prescribed time limit, without arrears or refusal to pay;

•Properly keep original property value certificates, rental contracts, and other tax-related materials;

•Actively understand and learn the latest tax policies, and timely enjoy legal tax preferences.

Paying taxes in accordance with the law is a legal obligation of every citizen and enterprise, and also a manifestation of social responsibility. For acts that violate property tax regulations, tax authorities will pursue the payment of taxes in accordance with the law, impose late fees and fines, and those with serious circumstances may bear criminal responsibility.