- Release Date:2025-08-19 08:00:24

- Reading volume: 0

Corporate income tax is one of the most important tax types in China and has a profound impact on business operations and financial planning. Exclusive Easy Finance and Taxation provides you with a comprehensive analysis of corporate income tax, helping enterprises operate legally and in compliance, and fully enjoy tax preferential policies. Exclusive Easy Finance and Taxation helps you avoid those invisible pitfalls! Help entrepreneurs operate in compliance and master the essential tax and finance survival guide - save money and comply!

Definition and Tax Law Basis of Corporate Income Tax

Corporate income tax is a type of income tax levied on the production and business operation income and other income of enterprises and other organizations that obtain income within the territory of China.

Main tax law basis:

The Enterprise Income Tax Law of the People's Republic of China (adopted on March 16, 2007 and effective as of January 1, 2008)

Regulations for the Implementation of the Enterprise Income Tax Law of the People's Republic of China

Relevant regulations and normative documents issued by the Ministry of Finance and the State Taxation Administration

The taxpayers of enterprise income tax are divided into resident enterprises and non-resident enterprises. Resident enterprises shall pay enterprise income tax on their income derived from both within and outside China. Non-resident enterprises shall only pay enterprise income tax on income derived from within the territory of China.

Objects and Scope of Enterprise Income Tax Collection

Corporate income tax is mainly levied on the production and business operation income and other income of enterprises, specifically including:

1. Income from the sale of goods: Such as the income obtained by manufacturing enterprises from selling self-produced products

2. Income from providing services: Such as the income obtained by service-oriented enterprises from providing consulting, design and other services

3. Gains from the transfer of property: Such as the income obtained by enterprises from the transfer of real estate, equipment, equity, etc

4. Dividends, bonuses and other income from equity investments

5. Interest income

6. Rental income

7. Royalty income

8. Accept donation income

9. Other income

Typical examples of situations where corporate income tax needs to be paid:

A certain manufacturing enterprise achieved an annual product sales revenue of 50 million yuan, and the profit after deducting costs and expenses was 8 million yuan

A certain technology company earned 3 million yuan by transferring a patented technology

An investment company received a dividend of 1.5 million yuan from the invested enterprise

A certain trading company suffered an annual operating loss but received a government subsidy of 2 million yuan

Corporate income tax payers include all types of enterprises (such as corporate enterprises, partnerships, etc.), public institutions, social organizations, private non-enterprise units and other organizations engaged in business activities. Sole proprietorships and partnerships are not subject to the Enterprise Income Tax Law, and their investors pay individual income tax.

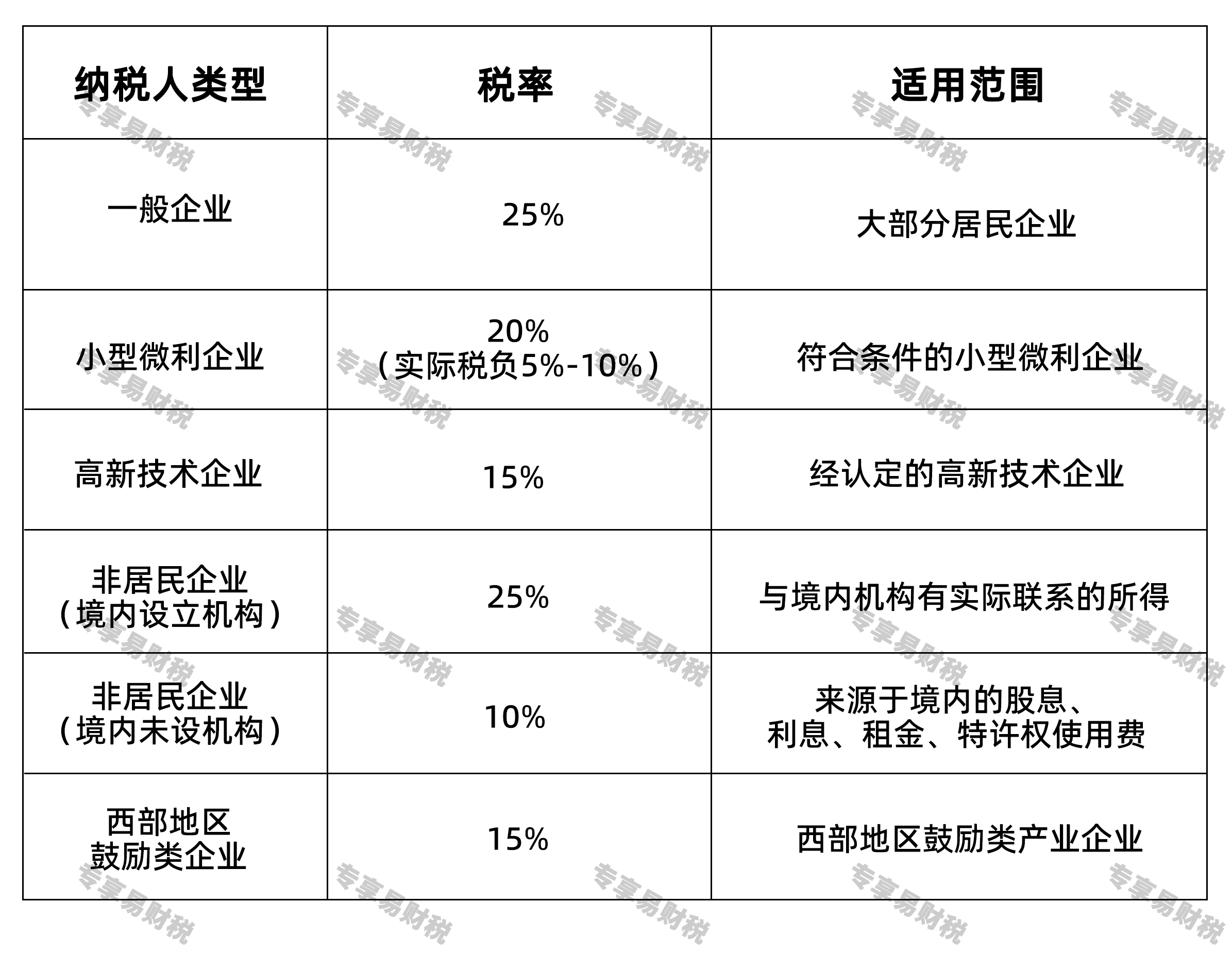

Main Tax Rates of Corporate Income Tax

In China, corporate income tax is subject to proportional tax rates. The main tax rates are as follows:

Standards for small and micro profit enterprises (Updated in 2023) : Annual taxable income does not exceed 3 million yuan, the number of employees does not exceed 300, and total assets do not exceed 50 million yuan.

Preferential Policies for Enterprise Income Tax

To encourage the development of specific industries, promote regional economic coordination and drive technological innovation, China has formulated a series of preferential policies for enterprise income tax:

High-tech enterprise preferential policies: High-tech enterprises that have been recognized are subject to a reduced tax rate of 15%

Additional deduction for research and development expenses: Research and development expenses of manufacturing enterprises can be deducted at 100%, while those of other enterprises can be deducted at 75%

Preferential policies for small and micro enterprises: During the period from January 1, 2023 to December 31, 2027, for small and micro enterprises, the portion of the annual taxable income not exceeding 3 million yuan shall be included in the taxable income at a reduced rate of 25%, and enterprise income tax shall be paid at a rate of 20%, with an actual tax burden of 5%.

Accelerated depreciation of fixed assets: For newly purchased fixed assets in specific industries, the depreciation period can be shortened or accelerated depreciation can be adopted

Income reduction and exemption from technology transfer: The portion of income from technology transfer not exceeding 5 million yuan is exempted, and the portion exceeding this amount is halved

Venture capital enterprises enjoy preferential policies: For those who have invested in unlisted small and medium-sized high-tech enterprises for at least two years, 70% of the investment amount can be deducted from the taxable income

Software and integrated circuit industry incentives: "Two years of exemption and three years of reduction by half" or a preferential tax rate of 10%

Environmental protection, energy conservation and water conservation project incentives: "Three years of exemption and three years of reduction by half" policy

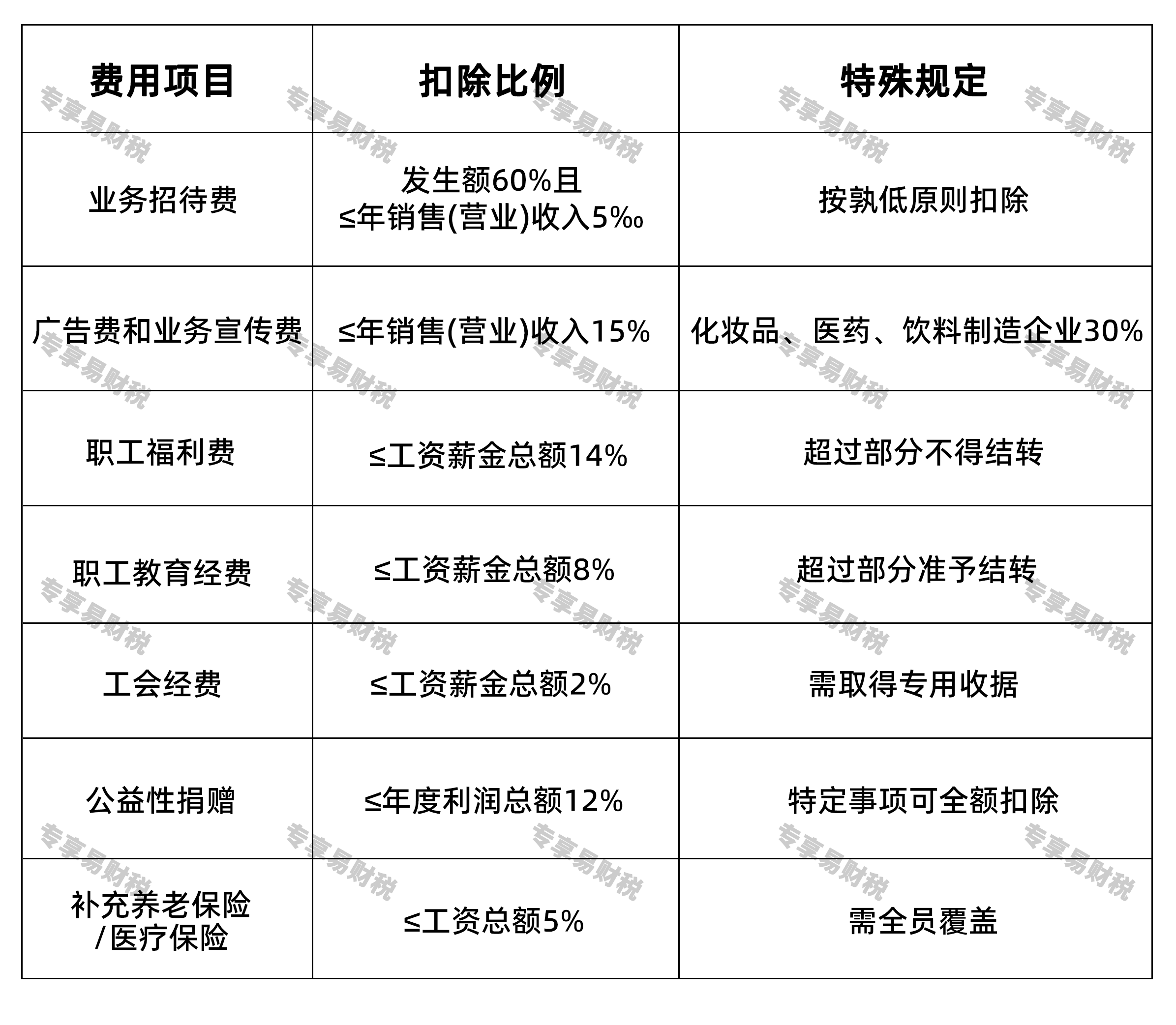

Pre-tax deduction ratios for Various Expenses

There are strict regulations on the pre-tax deduction items for enterprise income tax. The common expense deduction ratios are as follows:

The Significant Position of Corporate Income Tax

Corporate income tax holds an important position in China's tax system:

Corporate income tax is the second largest tax type in China, accounting for approximately 20-25% of the country's total tax revenue

In 2022, the national corporate income tax revenue reached 4.37 trillion yuan, accounting for 23.2% of the total tax revenue

Corporate income tax is a shared tax between the central and local governments (60% for the central government and 40% for local governments).

Corporate income tax contributes steadily to fiscal revenue and is an important source of funds for the government to provide public services

The enterprise income tax policy is an important tool for national macro-control, guiding industrial transformation and upgrading

Corporate income tax not only concerns the national fiscal revenue, but also directly affects the business operation decisions and profit distribution of enterprises. Reasonable tax planning and reducing tax burden under the premise of legality and compliance are important contents of enterprise financial management.

The Importance of Paying Taxes in Accordance with the Law

Corporate income tax, as a major tax type of the state, is subject to strict and standardized collection and management. Enterprises should establish a correct tax payment concept:

Strictly abide by tax laws: Calculate the tax payable in accordance with the law and declare and pay on time

Improve the financial system: Establish and improve the accounting system and standardize the management of vouchers

Pay attention to policy changes: Keep abreast of the latest tax policies and enjoy legal benefits

Prevent tax risks: Avoid illegal acts such as issuing false invoices and tax evasion

Professional tax and finance consultation: Utilize professional institutions for tax planning and risk control

In recent years, the tax authorities have continuously advanced the "streamline administration, strengthen regulation and improve services" reform, and at the same time, have utilized big data to enhance tax supervision. The Golden Tax Phase IV system has achieved full-process monitoring of business operations. Enterprises should enhance their compliance with tax laws to avoid economic penalties and credit losses caused by tax violations.

Guangzhou Exclusive Easy Finance and Taxation Company reminds: Honest tax payment is not only a legal obligation but also a manifestation of corporate social responsibility. Enterprises that pay taxes in accordance with the law will enjoy a better development environment and market reputation.

Conclusion

Enterprise income tax management is an important component of enterprise financial management. Through a thorough understanding of the enterprise income tax policies and regulations, enterprise income tax management is an important part of enterprise financial management. By thoroughly understanding the policies and regulations on enterprise income tax and rationally applying tax preferential policies, enterprises can optimize their tax burden and enhance their competitiveness under the premise of legality and compliance. Guangzhou Exclusive Easy Tax and Finance Company has a professional team of tax agents, providing enterprises with comprehensive tax consultation, tax planning and risk control services to help them develop healthily.