- Release Date:2025-08-12 08:00:55

- Reading volume: 0

Exclusive Easy Finance and Taxation Professional interpretation of the definition, collection and policies of tariffs. Exclusive Easy Finance and Taxation helps you avoid those invisible pitfalls! Help entrepreneurs operate in compliance and master the essential tax and finance survival guide - save money and comply!

Definition of Tariffs and Tax Law Basis

Tariff refers to a turnover tax levied by a country's customs on goods and articles entering or leaving the customs territory in accordance with the tariff tax law, tariff schedule and relevant regulations formulated by the state. Tariffs are a symbol of national sovereignty and one of the important sources of national fiscal revenue.

Main tax law basis:

Regulations of the People's Republic of China on Import and Export Duties

Customs Law of the People's Republic of China

"Import and Export Tariff of the People's Republic of China"

Provisional Regulations of the People's Republic of China on Value-Added Tax

Provisional Regulations of the People's Republic of China on Consumption Tax

The subject collecting tariffs is the state, and the customs is specifically responsible for the collection and management work on behalf of the state. The taxable objects of customs duties are goods and articles permitted to enter or exit the country. Among them, goods refer to trade import and export commodities, while articles refer to non-trade luggage, postal items, etc.

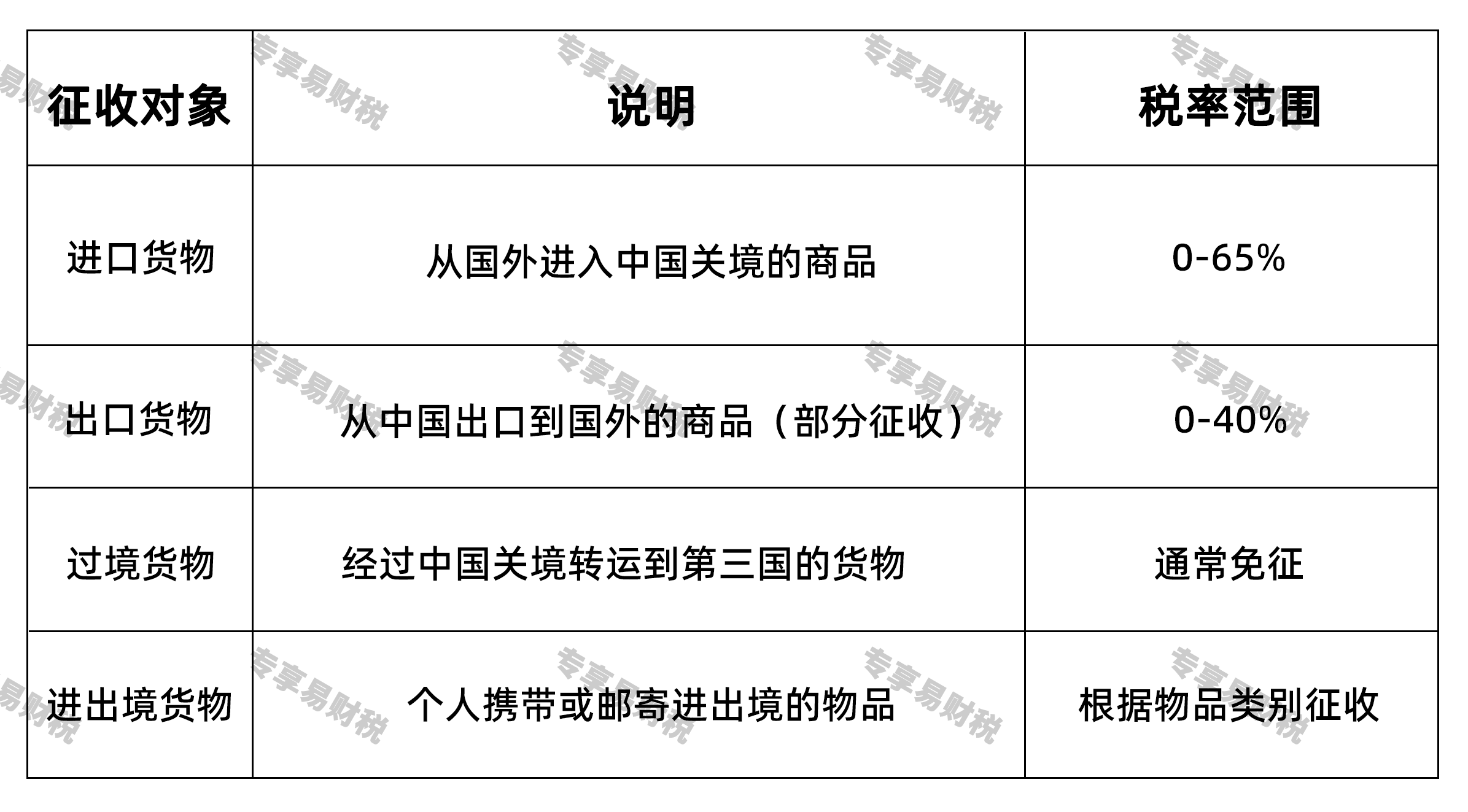

Objects of Tariff Collection and Taxpayers

Tariffs are mainly levied on the following behaviors or products:

Actual case

Case One: A trading company in Guangzhou imported a batch of mechanical equipment worth 1 million euros from Germany and was required to pay import duties, value-added tax and consumption tax (if applicable).

Case Two: When an individual purchases a luxury package worth more than 5,000 RMB from an overseas website, they need to pay the postal tax upon entry.

Case Three: A certain enterprise from Guangdong exports aluminum products to the United States. If the product falls under the category of resource products restricted by the state for export, it needs to pay export duties.

Tariff taxpayers: Consignees of imported goods, consignors of exported goods, and owners of inbound and outbound articles. In customs clearance practice, tax payment procedures are usually handled by customs declaration enterprises on their behalf.

Main Tariff Rates

China adopts various tariff rate forms to adapt to international trade rules and the needs of domestic economic development:

The most-favored-nation (MFN) rate: Applicable to WTO member states or countries/regions that have signed MFN treatment terms with China, it is the most commonly used rate.

Agreed tariff rates: Applicable to countries/regions that have signed free trade agreements or tariff preference agreements with China, such as ASEAN, member states of the Asia-Pacific Trade Agreement, etc.

Preferential tariff rates: Applicable to developing countries that have signed preferential trade agreements with China, such as some African countries.

General tariff rate: Applicable to countries/regions that have not signed any tariff preference agreements with China, the rate is the highest.

Tariff quota rate: For imported goods subject to tariff quota management, a lower rate applies within the quota, and a higher rate applies outside the quota.

Provisional tax rate: A temporary tax rate imposed by the state on specific import and export goods in accordance with the needs of macro-control.

The latest data for 2023: China's arithmetic average tariff rate has dropped to 7.4%, with an average rate of 13.8% for agricultural products and 6.9% for industrial products.

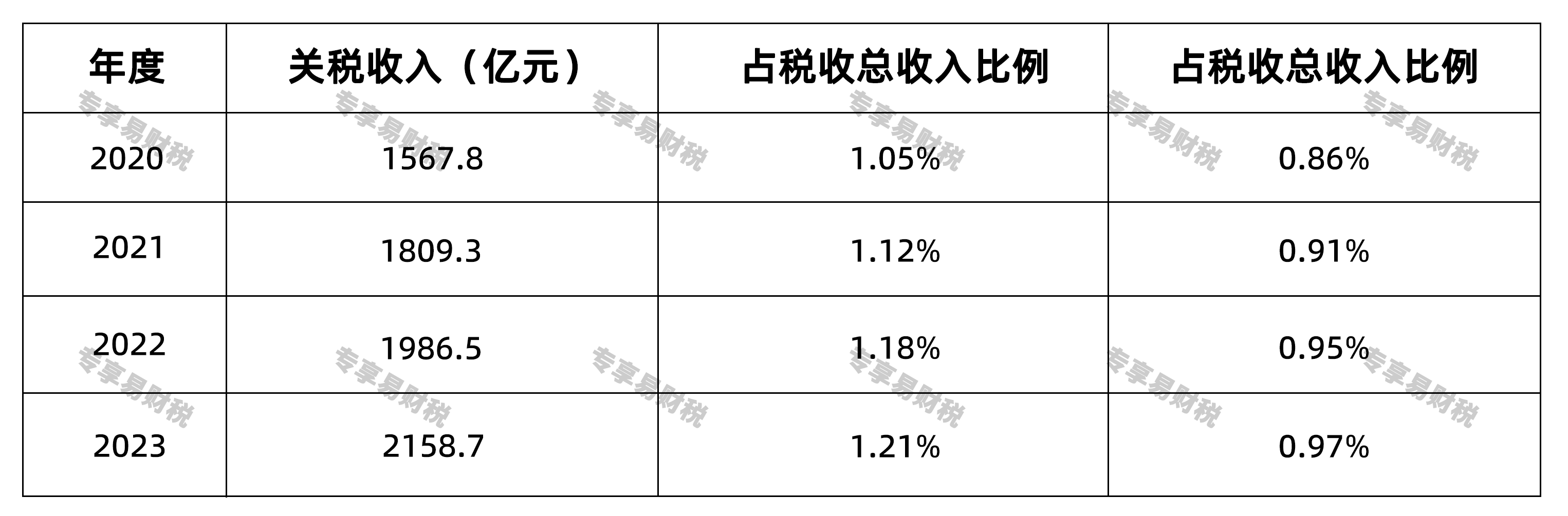

The Importance and Financial Status of Tariffs

Tariffs play a significant role in China's tax system and fiscal revenue:

The multiple functions of tariffs:

Fiscal revenue function: It contributes over 200 billion yuan in fiscal revenue to the country every year

Industrial protection function: Protect domestic infant industries and strategic emerging industries

Macro-control function: Regulate the total volume and structure of imports and exports, and balance the balance of payments

Trade policy tools: As an important bargaining chip in international trade negotiations

Consumption guidance function: Guide consumption direction through tax rates, such as reducing tariffs on anti-cancer drugs

Cultivating Awareness of Paying Taxes in Accordance with the Law

As one of the main types of taxes in the country, tariffs are strictly levied. Enterprises should firmly establish the awareness of paying taxes in accordance with the law.

Comply with customs laws and regulations: Accurately declare the classification, price and origin of goods, and truthfully provide documents and materials

Establish a compliance and internal control system: Improve the management system for import and export business and standardize the declaration process

Strengthen policy learning: Keep abreast of changes in tariff policies, especially the application of preferential tariff rates under free trade agreements

Prevent compliance risks: Avoid illegal acts such as underreporting prices, false reporting of goods, and fraud in origin

Make good use of professional services: Entrust professional customs declaration enterprises and financial and tax advisors to handle complex tariff affairs

According to the Customs Law, violations of tariff laws and regulations may result in the following penalties: supplementary payment of taxes, imposition of late payment surcharges (0.05% per day), and a fine ranging from 50% to five times the amount of unpaid taxes. In serious cases, criminal responsibility may be pursued.

As a professional tax and finance service provider deeply rooted in Guangzhou, Exclusive Easy Tax and Finance Company reminds you: In import and export business, compliant declaration and tax payment in accordance with the law are not only legal obligations, but also the foundation for enterprises to establish long-term credibility and reduce business risks. We will continue to provide you with professional tariff planning and compliance consulting services to help your enterprise develop healthily.