- Release Date:2025-08-05 08:00:04

- Reading volume: 0

Exclusive Easy Finance and Taxation Professional interpretation of the definition and collection scope of consumption tax. Exclusive Easy Finance and Taxation helps you avoid those invisible pitfalls! Help entrepreneurs operate in compliance and master the essential tax and finance survival guide - save money and comply!

Definition of Consumption Tax and Tax Law Basis

Consumption tax is a turnover tax levied on specific consumer goods and consumption behaviors, and it falls within the category of indirect taxes. It is an important component of China's tax system, aiming to regulate the product structure, guide the consumption direction and ensure the state's fiscal revenue.

The main legal basis for consumption tax in China is the "Interim Regulations of the People's Republic of China on Consumption Tax" (State Council Decree No. 539 of 2008) and its detailed implementation rules (Decree No. 51 of the Ministry of Finance and the State Administration of Taxation of 2008). These regulations clearly define the basic systems of consumption tax, including the scope of taxation, tax rates, tax payment stages and collection and management.

Consumption tax has the following characteristics:

The taxable items are selective

The tax collection stage is single (mainly levied at the production and import stages).

The collection methods are flexible (AD valorem rate, specific amount or compound tax calculation)

Tax burden is transferable (ultimately borne by consumers)

The Scope of Consumption Tax Collection and Taxpayers

Consumption tax is mainly levied on specific consumer goods. Currently, there are 15 tax items set, which are mainly divided into the following categories:

Excessive consumption of goods that are harmful to health, such as tobacco and alcohol

Luxury goods and non-essential items: such as precious jewelry and gemstones, high-end watches, and golf equipment

High energy consumption and high-end consumer goods: such as small cars and motorcycles

Non-renewable and irreplaceable resource-based consumer goods: such as refined oil products and solid wood flooring

Consumer goods with specific financial significance: such as firecrackers and fireworks Typical situations where consumption tax needs to be paid:

A certain distillery produces and sells Baijiu

Automobile manufacturers sell cars

The jewelry store retails gold and silver jewelry

Gas stations sell gasoline and diesel

Tobacco companies wholesale cigarettes

Imported high-end cosmetics

Consumption tax taxpayers: Units and individuals that produce, entrust processing and import taxable consumer goods within the territory of the People's Republic of China, as well as other units and individuals determined by The State Council to sell taxable consumer goods.

It should be noted that the taxpayers of consumption tax are different from the actual taxpayers. Taxpayers are usually producers or importers, but the actual tax burden will eventually be passed on to consumers.

Main Rates of Consumption Tax

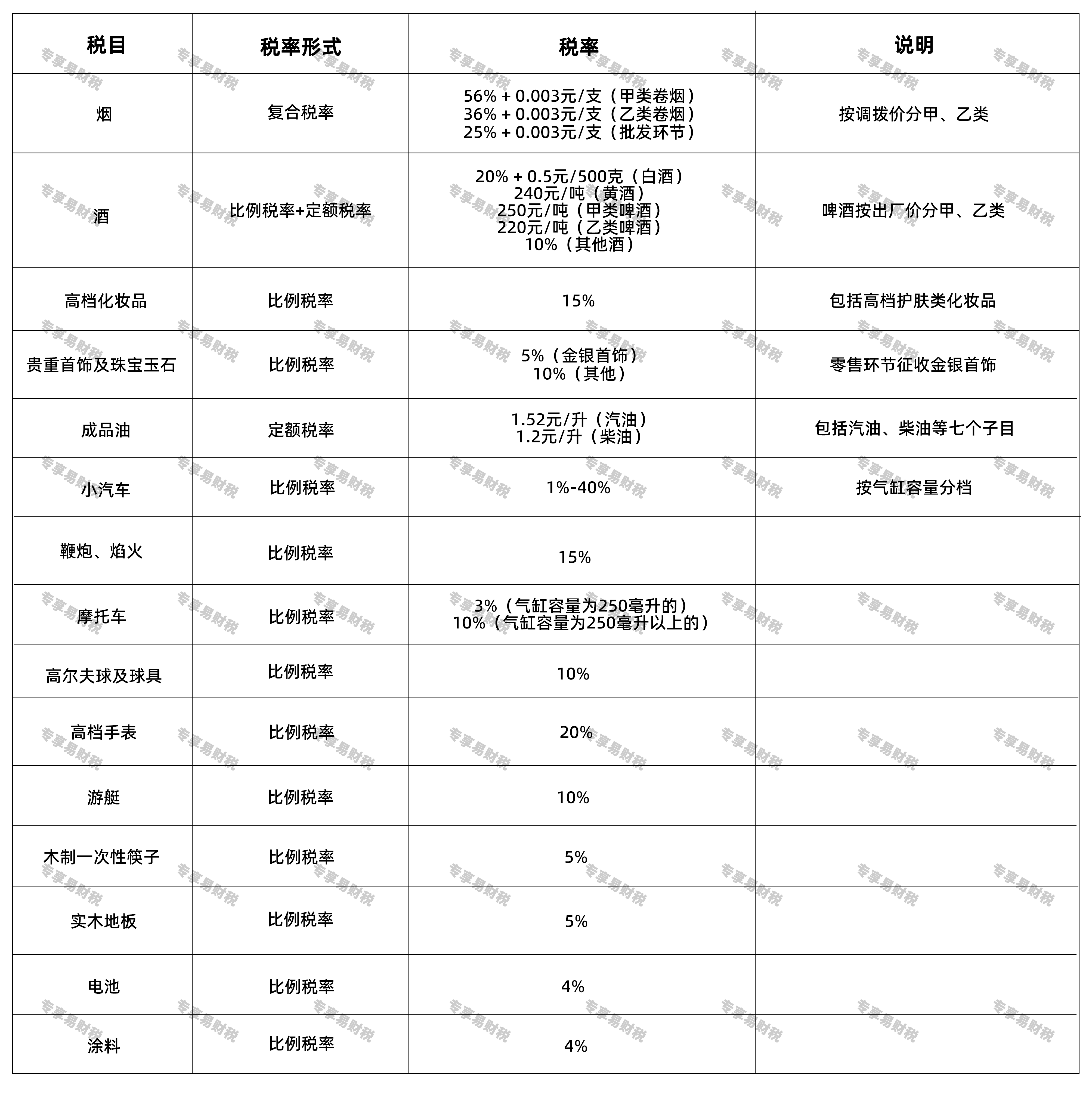

In China, consumption tax adopts three forms: proportional tax rate, fixed tax rate and compound tax rate.

It should be particularly noted that

Cigarettes and liquor are subject to a compound tax calculation (AD valorem + AD valorem).

Beer, yellow wine and refined oil products are subject to fixed-amount collection based on quantity

Other taxable consumer goods are basically subject to AD valorem rate collection

The Position of Consumption Tax in China's Tax System

Consumption tax is the third largest tax type in China's tax system, only after value-added tax and corporate income tax, and holds an important position in the central government's fiscal revenue.

The status of consumption tax

Consumption tax plays a significant role in China's fiscal system:

The function of fiscal revenue: Consumption tax is a stable source of income for the central government, contributing over 1.5 trillion yuan in tax revenue in 2023

Economic regulatory function: Guide consumption direction through differential tax rates and promote the rational allocation of resources

Income distribution function: Taxing luxury goods and high-end consumer goods to regulate income distribution

Industrial structure adjustment: Curb the development of high energy-consuming and high-polluting industries to promote economic transformation and upgrading

The Importance of Paying Taxes in Accordance with the Law

As one of the major tax types in our country, the collection and management of consumption tax is extremely strict. The state ensures the collection and administration of consumption tax through multiple measures:

The fourth phase system of the Golden Tax Project has achieved full-process monitoring

Implement source control over key industries (such as tobacco, alcohol, refined oil products, etc.)

Establish a cross-departmental information sharing mechanism

Implement a "blacklist" system for tax violations

In recent years, the tax authorities have maintained a high-pressure stance against violations of consumption tax. In 2023, over 3,200 cases of consumption tax violations were investigated and dealt with across the country, involving an amount exceeding 8.6 billion yuan. Among them, more than 150 cases were transferred to judicial authorities for handling.

As taxpayers, one should do:

Accurately determine one's own tax liability for consumption tax

Declare and pay the consumption tax in full and on time

Standardize the preservation of relevant receipts and accounting materials

Stay informed of the latest changes in consumption tax policies in a timely manner

Take the initiative to seek guidance from professional financial and tax advisors