- Release Date:2025-07-29 08:00:35

- Reading volume: 0

The definition and Tax law basis of Value-Added Tax (VAT) Value-added tax (VAT) is a turnover tax levied based on the value-added amount generated during the circulation of goods (including taxable services). The core feature of value-added tax is the tax levied on the added value or the added value of goods at multiple links in the production, circulation and labor services of goods.

In terms of the tax calculation principle, value-added tax is a turnover tax levied on the added value or the added value of goods at multiple links in the production, circulation and labor services of goods. An extra-price tax is implemented, meaning it is borne by consumers. Tax is levied only when there is added value, and no tax is levied when there is no added value.

Tax law basis: The main legal basis for value-added tax in China is the "Provisional Regulations of the People's Republic of China on Value-Added Tax" (State Council Decree No. 691) and its implementing rules. This regulation was promulgated by The State Council on December 13, 1993, and has been revised and improved many times since then. It is the basic regulation for the collection and administration of value-added tax in China. This regulation is currently in effect and will expire on December 31, 2025.

The new "Value-Added Tax Law of the People's Republic of China" was adopted at the 13th meeting of the Standing Committee of the 14th National People's Congress of the People's Republic of China on December 25, 2024, and will come into effect on January 1, 2026.

Analysis of the value-added Concept of value-added Tax: The object of value-added tax collection is the value-added amount, that is, the new value created by enterprises in the process of production and operation. Value-added is relative to the purchase cost of an enterprise. The specific calculation formula is:

Value-added amount = sales amount - purchase cost.

Here, "value-added" refers to the added value portion that an enterprise adds during the production of goods or the provision of services, which is the contribution made by the enterprise to the value-added of products/services.

For example, suppose the production and operation process of a furniture manufacturing enterprise:

Wood supplier: Sells wood to the furniture factory at a price of 1,000 yuan (assuming no purchase cost), with a value increase of 1,000 yuan.

Furniture manufacturing factory: Processes wood into furniture and sells it to retailers at 2,500 yuan, with a value increase of 2,500-1,000 = 1,500 yuan.

Retailer: Selling furniture to consumers for 3,500 yuan, the value-added amount = 3,500-2,500 = 1,000 yuan.

The total value-added amount throughout the entire commodity circulation process = 1,000 + 1,500 + 1,000 = 3,500 yuan. Value-added tax is the tax levied on this 3,500 yuan value-added amount.

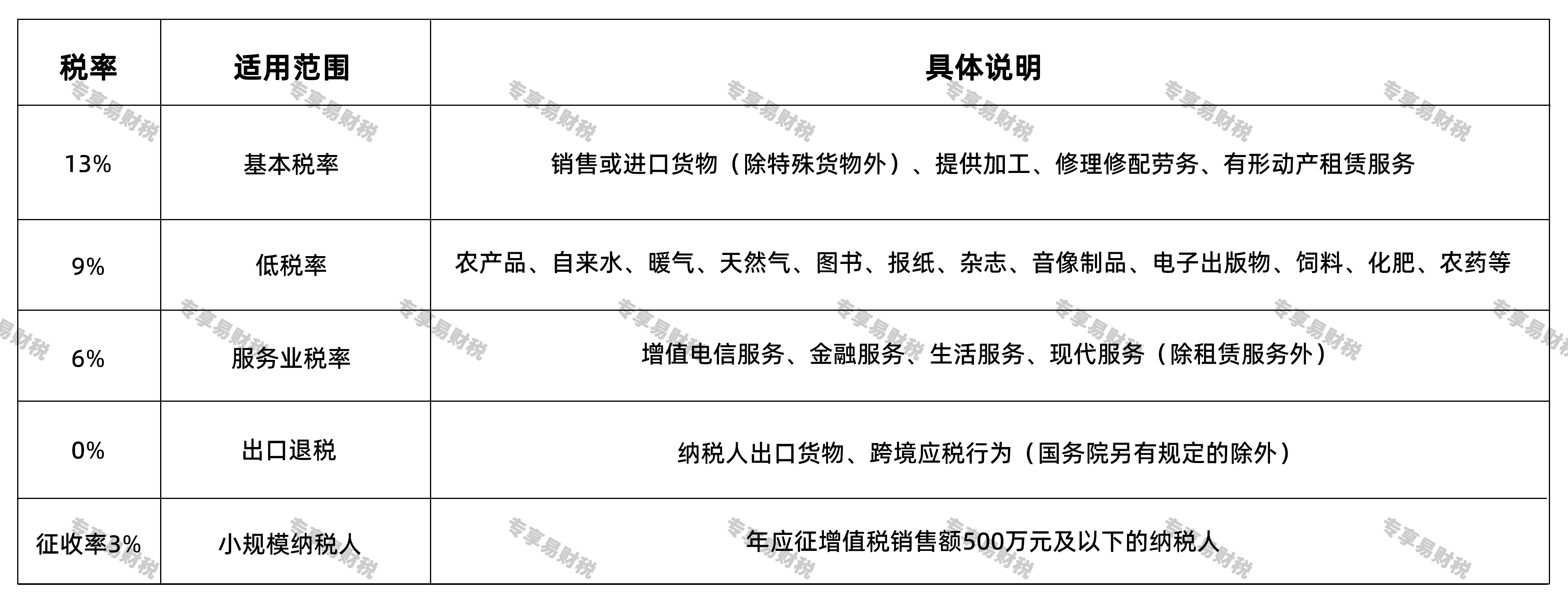

According to the current VAT policy of our country, the main VAT rates are divided into the following tiers:

In addition, for some industries and special businesses, such as the purchase of agricultural products and the advance payment of construction services, there are also special collection regulations.

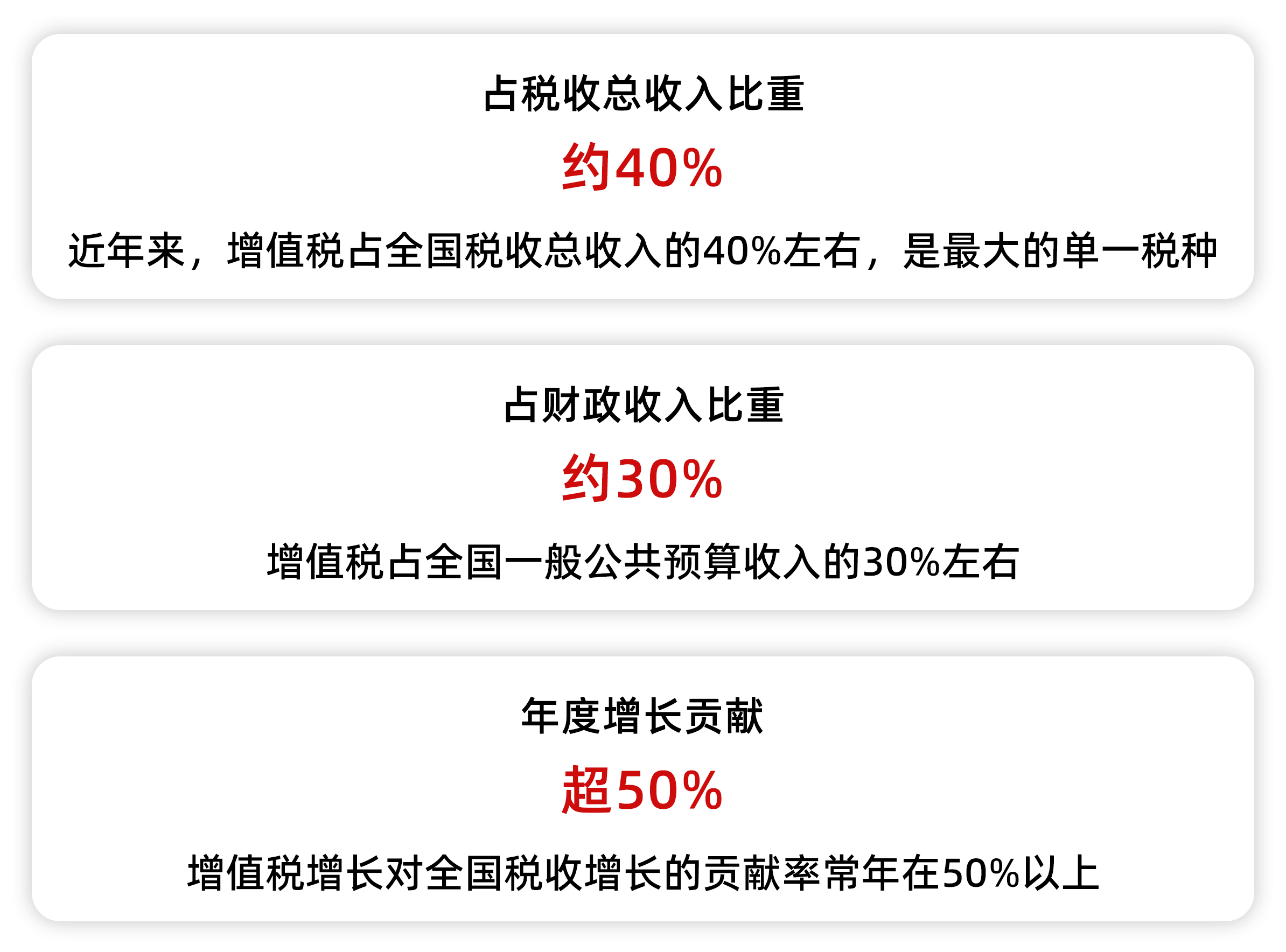

The fiscal status of value-added Tax in China Value-added Tax is the largest tax type in our country and holds a crucial position in fiscal revenue.

Value-added tax (VAT) plays an irreplaceable and significant role in China's fiscal system:it provides a stable and reliable source of fiscal revenue for the country, promotes industrial specialization and division of labor and cooperation, facilitates the implementation of export rebate policies, promotes foreign trade, guides industrial structure adjustment through differential tax rates, forms a complete tax deduction chain, and reduces tax evasion and tax fraud

The Importance and suggestions of paying taxes in accordance with the law:

As the most important tax type in our country, the collection and management of value-added tax is extremely strict. The state has established a modern tax collection and administration system with the Golden Tax system at its core, implementing full life-cycle management of value-added tax invoices and adopting a "zero-tolerance" attitude towards tax violations.

Enterprises must establish a correct tax payment concept Strictly abide by value-added tax laws and regulations, declare and pay taxes on time and in full, establish and improve financial systems and value-added tax special invoice management systems, obtain and use value-added tax special invoices in accordance with the law, and eliminate the behavior of issuing false invoices. Regularly conduct tax health checks, promptly discover and correct tax-related issues, and actively cooperate with the inspection and auditing work of tax authorities

Paying taxes in accordance with the law is not only a legal obligation of enterprises, but also a manifestation of their social responsibility and a guarantee for their sustainable and healthy development. Guangzhou Exclusive Easy Finance and Taxation Company reminds you: Respect tax laws, pay taxes in accordance with the law, and jointly build a trustworthy business environment.