- Release Date:2025-10-28 08:00:10

- Reading volume: 0

01The definition of urban maintenance and construction tax and its tax law basis

Urban maintenance and construction tax (referred to as urban construction tax) is an additional tax levied on units and individuals who pay value-added tax and consumption tax, based on the actual amount of value-added tax and consumption tax they pay.

Its main tax law basis is the "Urban Maintenance and Construction Tax Law of the People's Republic of China", which came into effect on September 1, 2021. At the same time, the "Interim Regulations of the People's Republic of China on Urban Maintenance and Construction Tax" issued by The State Council on February 8, 1985 was abolished.

02The scope of collection, taxpayers and collection circumstances of urban maintenance and construction tax

1.Scope of collection

The scope of collection of urban maintenance and construction tax is directly related to that of value-added tax and consumption tax. Any unit or individual that needs to pay value-added tax and consumption tax must also pay urban maintenance and construction tax at the same time.

2.Taxpayer

Units and individuals who pay value-added tax and consumption tax within the territory of the People's Republic of China are taxpayers of urban maintenance and construction tax. Specifically including:

All types of enterprises, individual business households and other units that pay value-added tax

Production enterprises, entrusted processing enterprises and import enterprises that pay consumption tax

Foreign-invested enterprises, foreign enterprises and foreign individuals that pay value-added tax and consumption tax within the territory of China

Other units and individuals that are legally required to pay value-added tax and consumption tax

Examples of situations where urban maintenance and construction tax needs to be paid:

-A certain manufacturing enterprise that sells products in Guangzhou generates value-added tax and needs to calculate and pay the urban construction tax based on the value-added tax amount

-A certain trading company in Shenzhen needs to pay both value-added tax and consumption tax when importing goods, and also needs to pay urban construction tax at the same time

-A certain catering enterprise in Foshan City needs to calculate and pay the urban construction tax based on the value-added tax amount when providing catering services

-A certain cosmetics manufacturing enterprise that produces and sells cosmetics in Dongguan City and pays consumption tax needs to calculate and pay urban construction tax based on the amount of consumption tax

-A certain construction company providing construction services in Zhuhai City needs to pay value-added tax and urban construction tax at the same time

-Individuals engaged in individual business operations in Guangzhou who pay value-added tax need to calculate and pay the urban construction tax based on the value-added tax amount

-A certain 4S car store in Shenzhen needs to pay urban construction tax at the same time when selling cars and paying value-added tax

-A certain tobacco company sells cigarettes in Foshan City and pays consumption tax. It needs to calculate and pay urban construction tax based on the amount of consumption tax

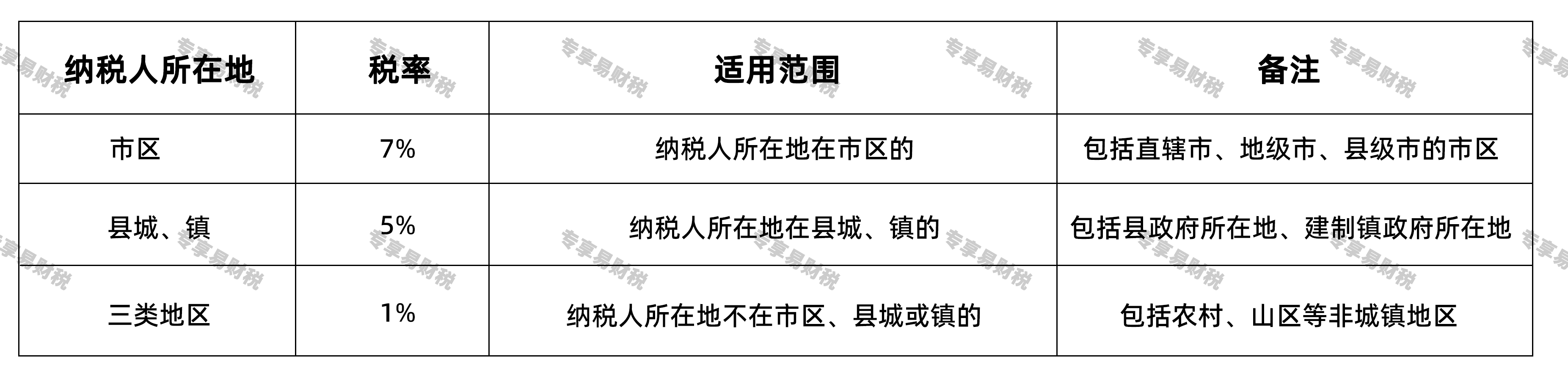

03The several main tax rates of urban maintenance and construction tax

Urban maintenance and construction tax is subject to regional differential proportional tax rates based on the location of taxpayers. The specific tax rate standards are as follows:

Note: The location of the taxpayer refers to the registered address of the taxpayer or the actual place of production and operation. For taxpayers who pay value-added tax and consumption tax in a consolidated manner, the place of payment for urban maintenance and construction tax shall be the respective locations of their head office and branches.

04Preferential policies for urban maintenance and construction tax

According to the "Urban Maintenance and Construction Tax Law of the People's Republic of China" and relevant policy regulations, the main tax reduction and exemption benefits include:

Exemption circumstances:

1.Value-added tax and consumption tax levied on imported goods are not subject to urban maintenance and construction tax

2.Where value-added tax and consumption tax are refunded for exported goods, the urban maintenance and construction tax already paid shall not be refunded

3.Where the value-added tax and consumption tax are subject to the methods of collection first and then refund, collection first and then refund, or immediate collection and immediate refund, the urban maintenance and construction tax levied in conjunction with the value-added tax and consumption tax shall not be refunded, except as otherwise provided

Circumstances for tax reduction:

The urban maintenance and construction tax is exempted for the national major water conservancy project construction fund

For small-scale taxpayers, the urban maintenance and construction tax can be reduced by up to 50% of the tax amount

For taxpayers who are subject to the end-of-period carryover VAT refund, they are allowed to deduct the refunded VAT amount from the tax base for urban maintenance and construction tax

For enterprises in industries that are facing difficulties due to the impact of the epidemic, they will enjoy the policy of phased reduction or exemption of urban maintenance and construction tax as stipulated

05The proportion of urban maintenance and construction tax in all tax revenue in China and its significant position in China's fiscal revenue

Urban maintenance and construction tax is an important tax type in China's tax system and belongs to local taxes. All its income belongs to the local government and it is one of the important sources of local fiscal revenue.

According to the annual fiscal revenue and expenditure data released by the Ministry of Finance of the People's Republic of China, the tax revenue from urban maintenance and construction has the following characteristics:

1.It accounts for a stable proportion in local tax revenue and is an important financial guarantee for local governments

2.Income scale is closely related to the level of economic development. Economically developed regions have higher incomes

3.The funds are used exclusively for the maintenance and construction of urban public facilities and public utilities

4.It plays a key role in improving urban infrastructure and enhancing urban functions

Although the urban maintenance and construction tax does not account for the largest proportion of the total national tax revenue, it holds an irreplaceable and significant position in supporting urban development, improving the living environment, and promoting urbanization. Especially in big cities and developed areas, the urban construction tax provides a stable source of funds for urban infrastructure construction.

06Awareness of paying taxes in accordance with the law

Urban maintenance and construction tax, as an important tax type for the state to raise funds for urban construction and improve the urban living environment, has very strict collection and management policies. Tax authorities ensure the timely and full collection of taxes through measures such as improving the tax collection and administration mechanism, strengthening tax source monitoring, and intensifying inspection efforts.

As taxpayers and tax-related professional service institutions, it is essential to deeply understand that paying urban maintenance and construction tax in accordance with the law is a legal obligation that every unit and individual should fulfill. We must firmly establish the tax concept of "taking from the people and using for the people", accurately understand and master the laws, regulations and policies of urban construction tax, and fulfill the obligation of urban construction tax declaration in accordance with the law while paying value-added tax and consumption tax. Guangzhou Exclusive Easy Finance and Taxation Company reminds you: Respecting tax laws and paying taxes in accordance with the law is not only a basic requirement of the law, but also a manifestation of the social responsibility of enterprises and citizens. Timely and full payment of urban construction tax not only contributes to urban development but also creates a better business environment and living conditions for oneself, jointly promoting high-quality urban development.