- Release Date:2025-08-22 10:11:46

- Reading volume: 0

Individual income tax reduction will come into effect on January 1, 2026!

Individual income tax reduction will come into effect on January 1, 2026!

On July 29th, the Tax Bureau of Henan Province issued an announcement titled "Announcement on Policies for Reducing Personal Income Tax on the Income of Disabled, Elderly and Orphaned Individuals and Families of Martyrs, as well as Those Suffering Major Losses Due to Natural Disasters".

The announcement clearly states:

1.For the comprehensive income and business income of the disabled, the elderly living alone and the families of martyrs, the taxable amount shall be reduced by a limit of 8,000 yuan per person per year. For amounts less than 8,000 yuan, the actual amount will be reduced.

2. In cases where major losses are suffered due to natural disasters, the provincial government shall determine them separately based on the extent of the disaster.

Major losses caused by natural disasters refer to the significant losses suffered by taxpayers due to strong winds, hail, floods, earthquakes, landslides, mudslides and other natural disasters.

3. Where a taxpayer meets both the circumstances stipulated in Article 1 and Article 2 of this announcement, the most favorable policy shall apply and shall not be cumulatively implemented.

This announcement shall come into effect as of January 1, 2026. In addition, everyone can enjoy a number of individual income tax benefits in 2025.

An additional deduction for individual income tax has been added, allowing for an extra deduction of 12,000 yuan each year

The Ministry of Finance, the State Taxation Administration and four other departments jointly issued the "Notice on Fully Implementing the Personal Pension System".

The Notice clearly states:

Starting from December 15, 2024, all workers who have participated in the basic endowment insurance for urban employees or the basic endowment insurance for urban and rural residents within the territory of China can join the individual pension system.

Meanwhile, the Ministry of Finance and the State Taxation Administration jointly issued the "Announcement on Implementing Personal Income Tax Preferential Policies for Personal Pensions Nationwide".

The Notice clearly states:

Starting from January 1, 2024, the preferential policy of deferred tax payment for individual pensions will be implemented nationwide

At the contribution stage, the individual's contribution to the personal pension fund account, up to a limit of 12,000 yuan per year, can be deducted from the comprehensive income or business income on a factual basis.

In the investment stage, the investment income credited to the individual pension fund account is temporarily exempt from individual income tax.

At the withdrawal stage, the personal pensions withdrawn by individuals are not included in their comprehensive income. They are subject to individual income tax at a separate rate of 3%, and the tax paid is recorded under the "Wages and Salaries" item.

To facilitate everyone's understanding, here is an example for you:

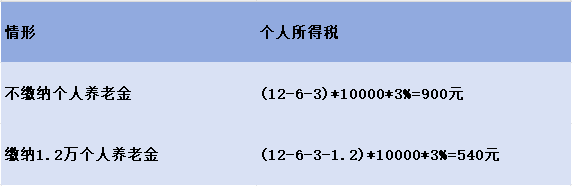

Assuming that the annual income of a junior college in 2025 is 120,000 yuan, the deductible amount for the three social insurances and one housing fund as well as special additional deductions is 30,000 yuan. Then for junior colleges:

In conclusion, contributing 12,000 yuan to the personal pension can save 360 yuan in individual income tax.

Therefore, under the condition that the tax rate is not affected, the amount of personal income tax that can be saved = the actual personal pension paid in the current year × the corresponding tax rate of personal comprehensive income.

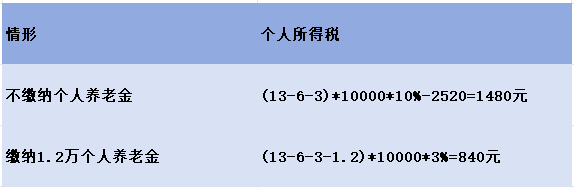

When it comes to cases that affect tax rates, the tax-saving effect is even more obvious, for example:

Assuming that the annual income of a junior college in 2025 is 130,000 yuan, the deductible amount for the three social insurances and one housing fund as well as special additional deductions is 30,000 yuan. Then for junior colleges:

At this point, personal income tax can be reduced by 640 yuan

The most comprehensive individual income tax rate table and the latest special additional deduction table

Nine types of income subject to personal income tax:

✦ Comprehensive income: Income from wages and salaries; Income from remuneration for services; Income from royalties; Royalty income.

✦ Sub-item income: Business income; Income from interest, dividends and bonuses; Income from property leasing; Income from the transfer of property; Obtained by chance.

1.Table of Withholding Rates for Individual Wages and Salaries of Residents

2. Income from personal services, royalties, and fees for the use of intellectual property rights by residents

Income from remuneration for services, income from manuscripts, and income from the use of rights shall be subject to the withholding and prepayment of taxable income based on the amount of each income, and the amount of tax to be withheld and prepaid shall be calculated.

Income amount: For income from labor services, income from manuscripts, and income from the use of rights, the income amount shall be the balance after deducting expenses from the income. Among them, the income from literary remuneration is calculated at a reduced rate of 70%.

Deduction of expenses: When withholding and prepaying taxes, for income from labor services, royalties, and fees for the use of rights, if each income does not exceed 4,000 yuan, the deduction of expenses shall be calculated at 800 yuan. For each income exceeding 4,000 yuan, the deduction expense shall be calculated at 20% of the income.

3.Comprehensive Income Tax Rate Table (Applicable during Individual Income Tax Settlement and Final Payment)

Comprehensive income refers to the income from wages and salaries obtained by resident individuals. Income from remuneration for services; Income from royalties and income from the use of intellectual property rights shall be subject to a progressive tax rate ranging from 3% to 45% (the withholding rate table is shown in the aforementioned 1 and 2).

4.Business income tax rate table

4.Business income tax rate table

5.Income from interest, dividends and bonuses; Income from property leasing; Income from the transfer of property and windfall gains

Income from interest, dividends and bonuses; Income from property leasing; Income from the transfer of property and windfall gains are subject to a proportional tax rate of 20%. This tax rate applies to both resident individuals and non-resident individuals.

6.One-time annual bonus

Individual declaration: Tax payable = Annual one-time bonus income × Applicable tax rate - Quick deduction number

(Note: The applicable tax rate is determined by dividing the one-time annual bonus income by 12 months and referring to the monthly tax rate table.)

Consolidated into comprehensive income: Tax payable = (Annual income - Deduction expenses - Additional deductions - Special additional deductions - Other deductions) × Tax rate - Quick deduction number. Applicable tax rate table for separate declaration

Seven exclusive additional deductions for individual income tax

They are seven special additional deductions, namely: children's education, continuing education, major medical expenses, interest on housing loans, housing rent, support for the elderly, and care for infants under three years old. These are all tax refund tips. Each one can be used to offset your taxable income. The more you offset, the less tax you will pay naturally.

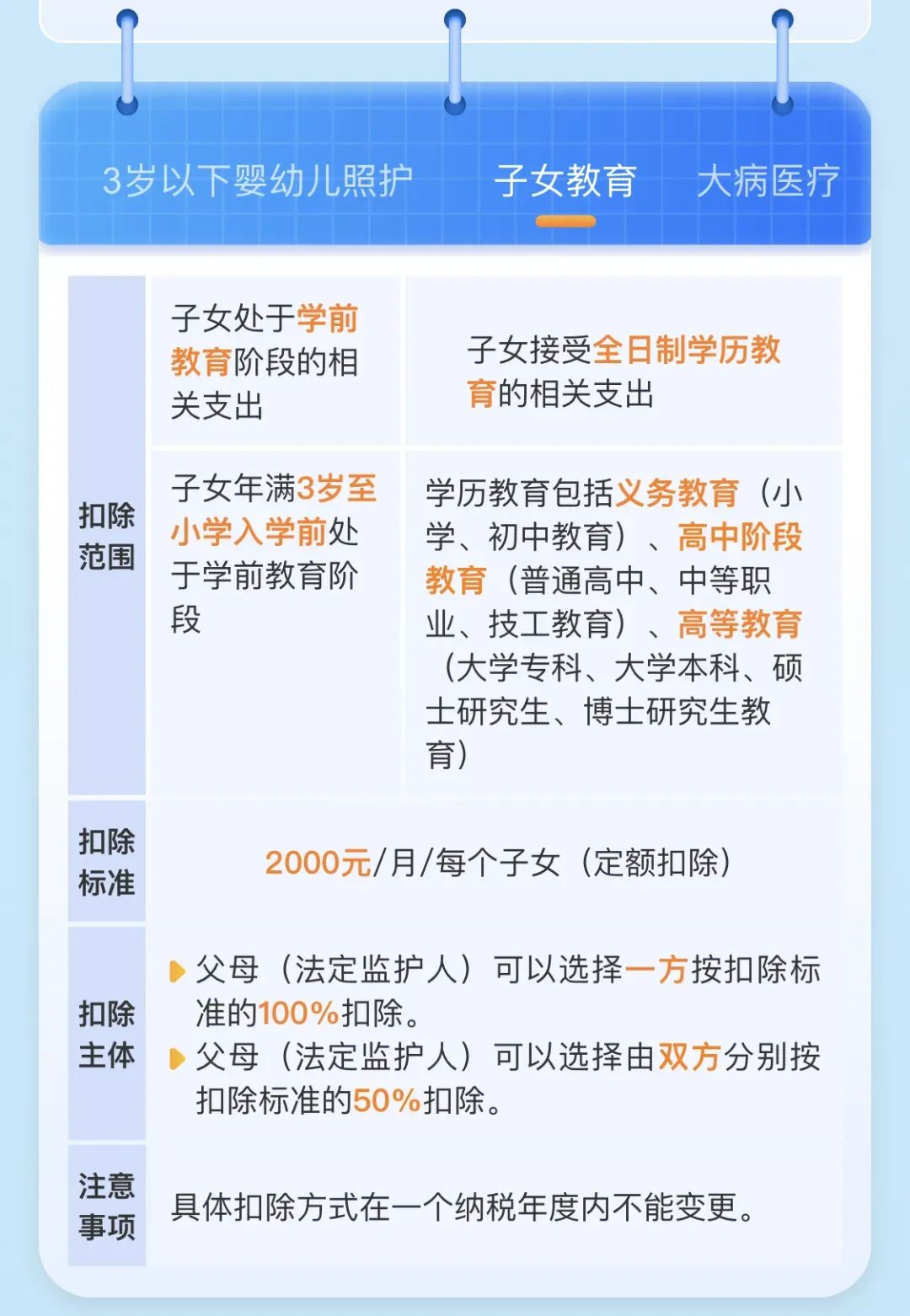

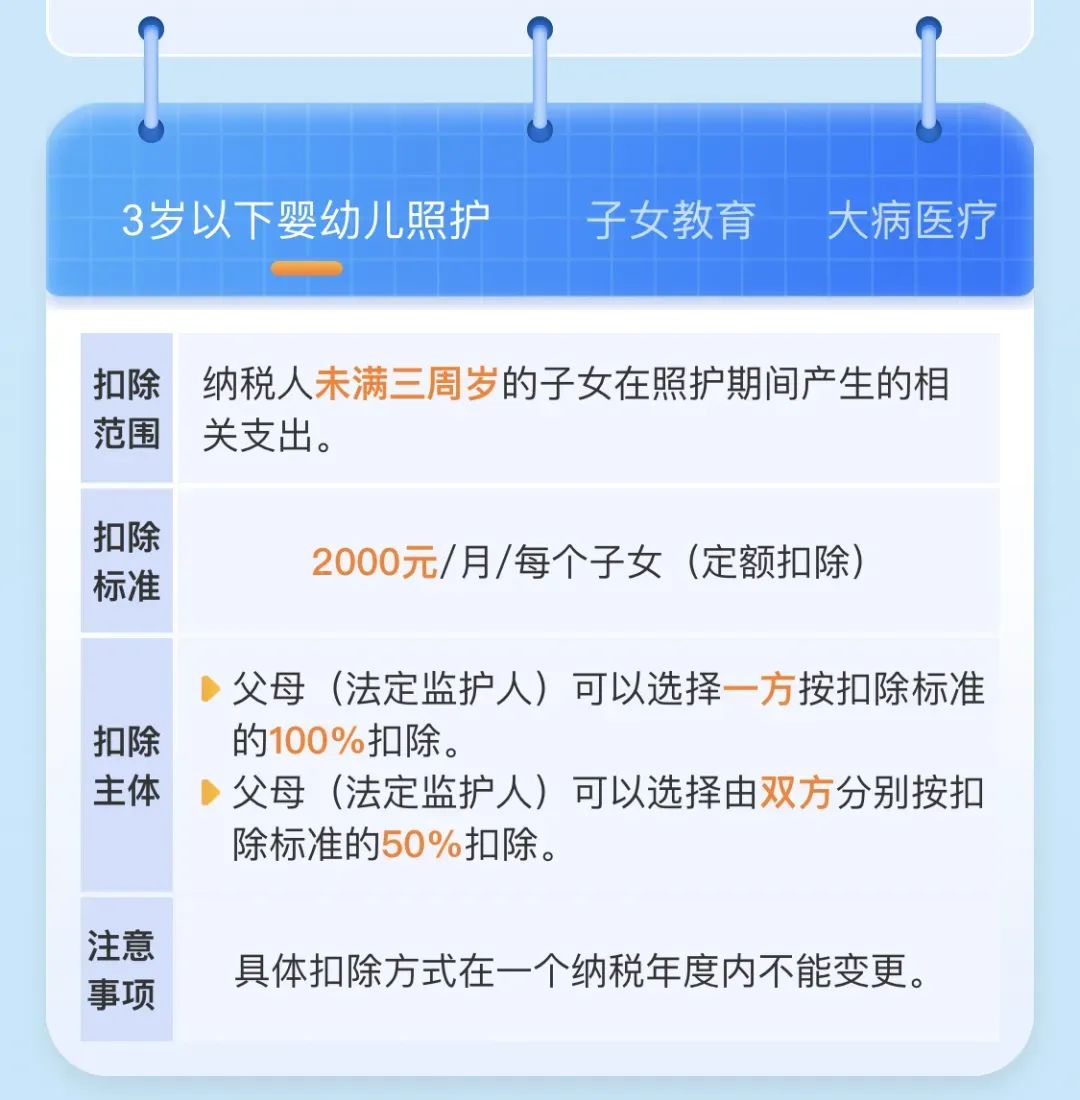

Children's education

The relevant expenses for the children of taxpayers to receive full-time academic education shall be deducted at a fixed rate of 2,000 yuan per child per month.

Academic education includes compulsory education (primary and junior high school education), senior high school education (general senior high school, secondary vocational education, and technical education), and higher education (junior college, undergraduate, master's degree, and doctoral degree education).

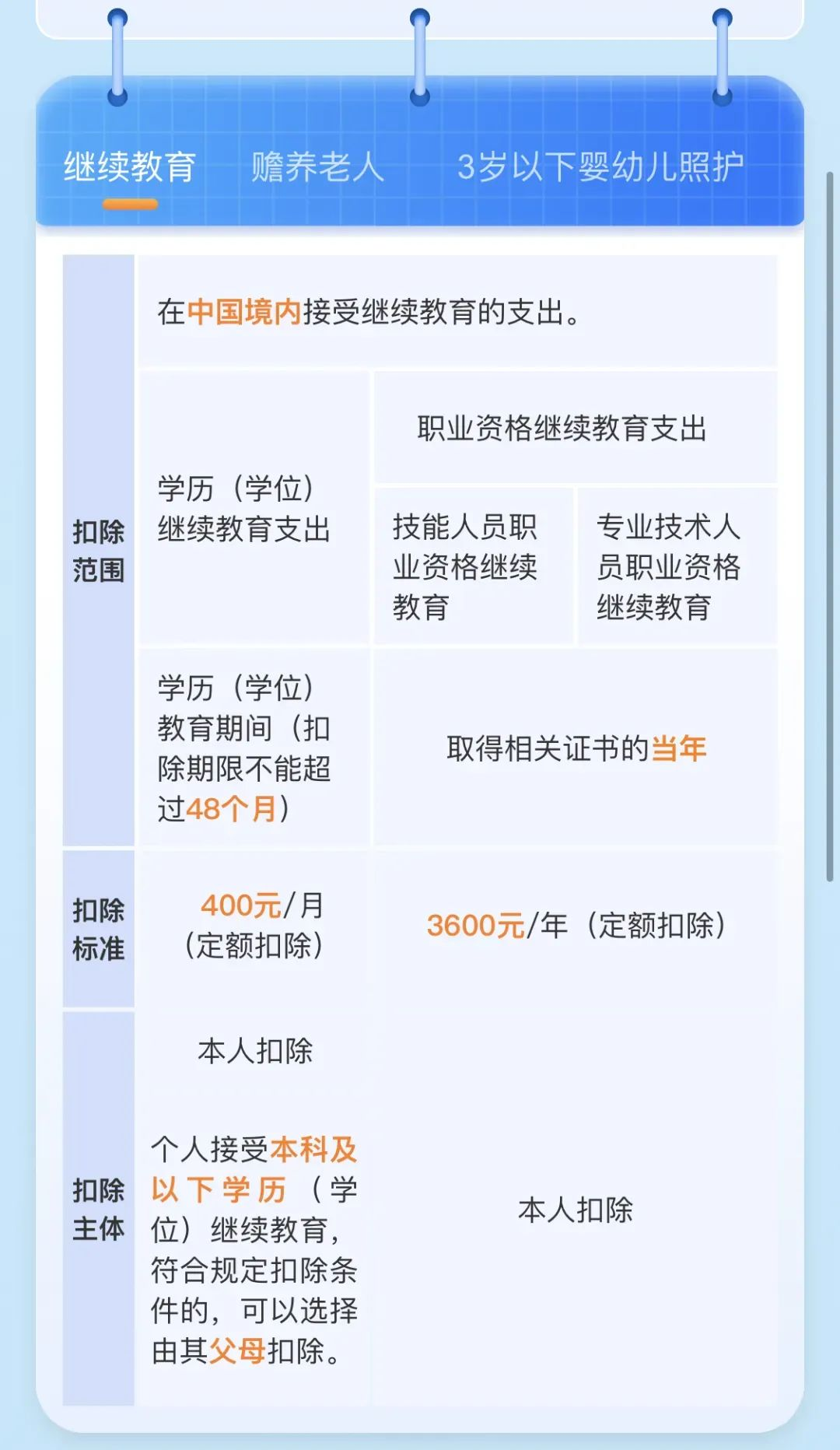

Continuing education

Taxpayers' expenditures on continuing education for academic qualifications (degrees) within the territory of China can be deducted at a fixed rate of 400 yuan per month during the period of academic qualifications (degrees) education. The deduction period for continuing education of the same academic degree cannot exceed 48 months.

The expenses incurred by taxpayers for continuing education on vocational qualifications for skilled personnel and professional and technical personnel can be deducted at a fixed amount of 3,600 yuan in the year when the relevant certificates are obtained.

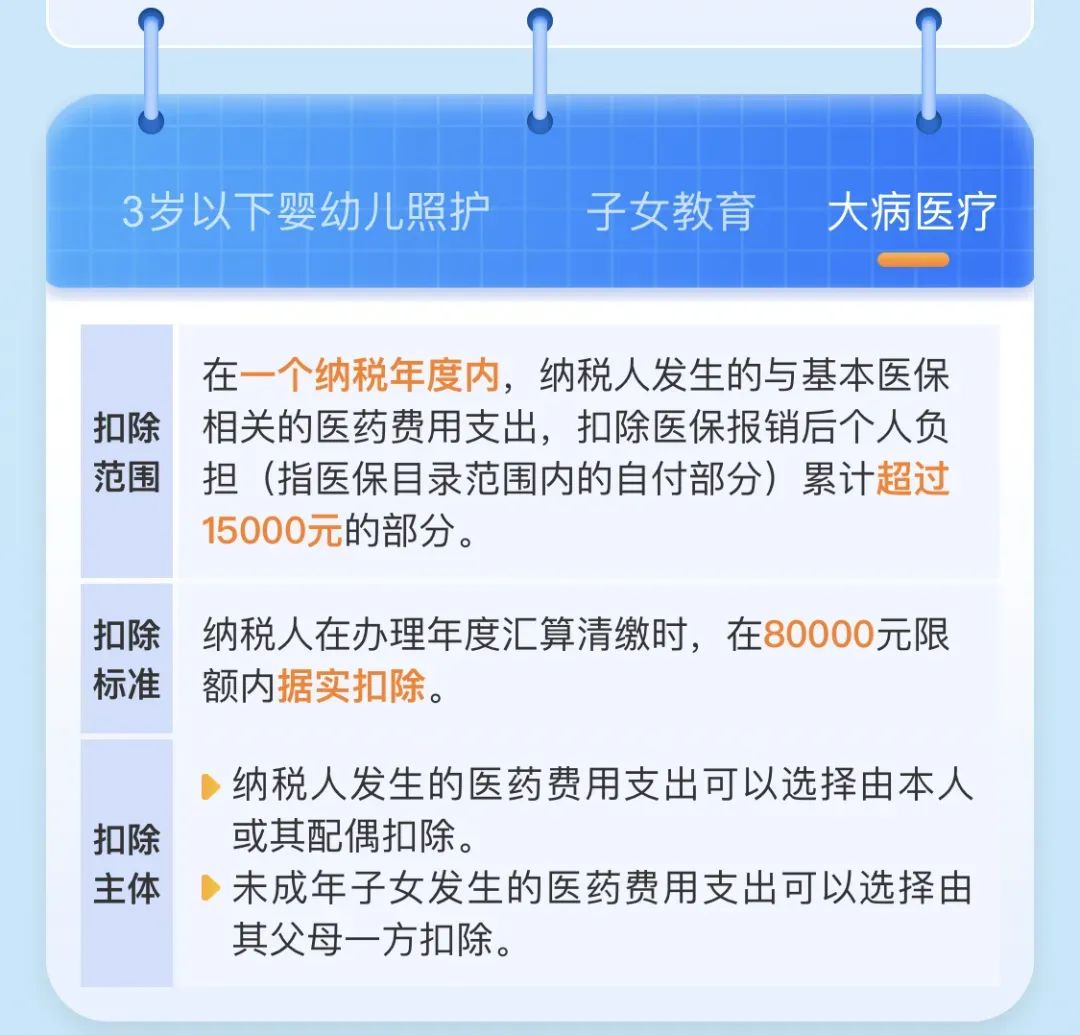

Medical treatment for serious illness

Within a tax year, for the medical expenses related to basic medical insurance incurred by taxpayers, the portion of the personal burden (referring to the self-paid portion within the scope of the medical insurance directory) that exceeds 15,000 yuan after deducting medical insurance reimbursement shall be deducted by the taxpayers within the limit of 80,000 yuan when handling the annual settlement and final payment.

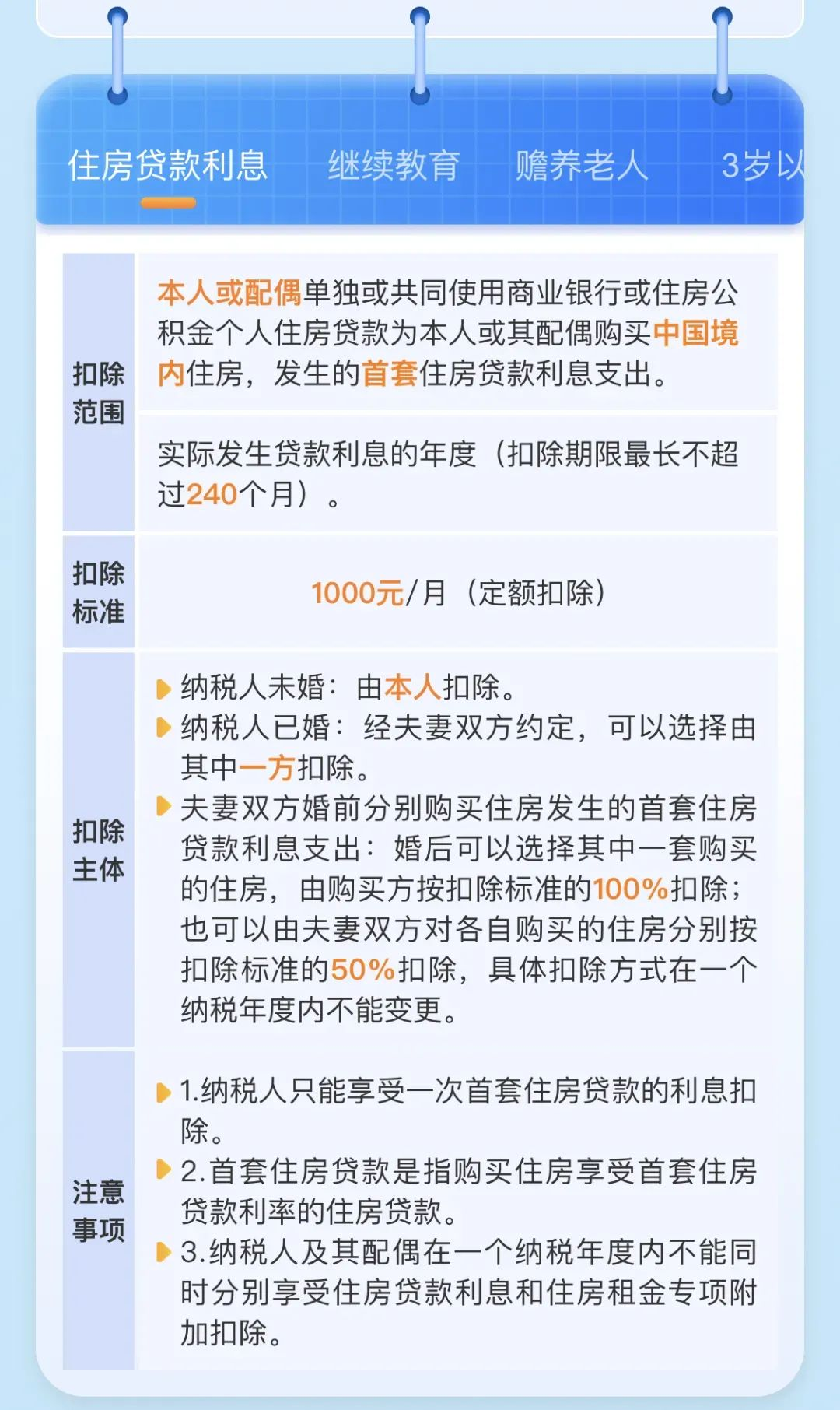

Interest on housing loans

When a taxpayer or their spouse uses a commercial bank or housing provident fund personal housing loan alone or jointly to purchase a house within the territory of China for themselves or their spouse, the interest expense on the first home loan incurred shall be deducted at a fixed rate of 1,000 yuan per month in the year when the loan interest actually occurs, and the deduction period shall not exceed 240 months at the longest. Taxpayers can only enjoy the interest deduction for their first home loan once.

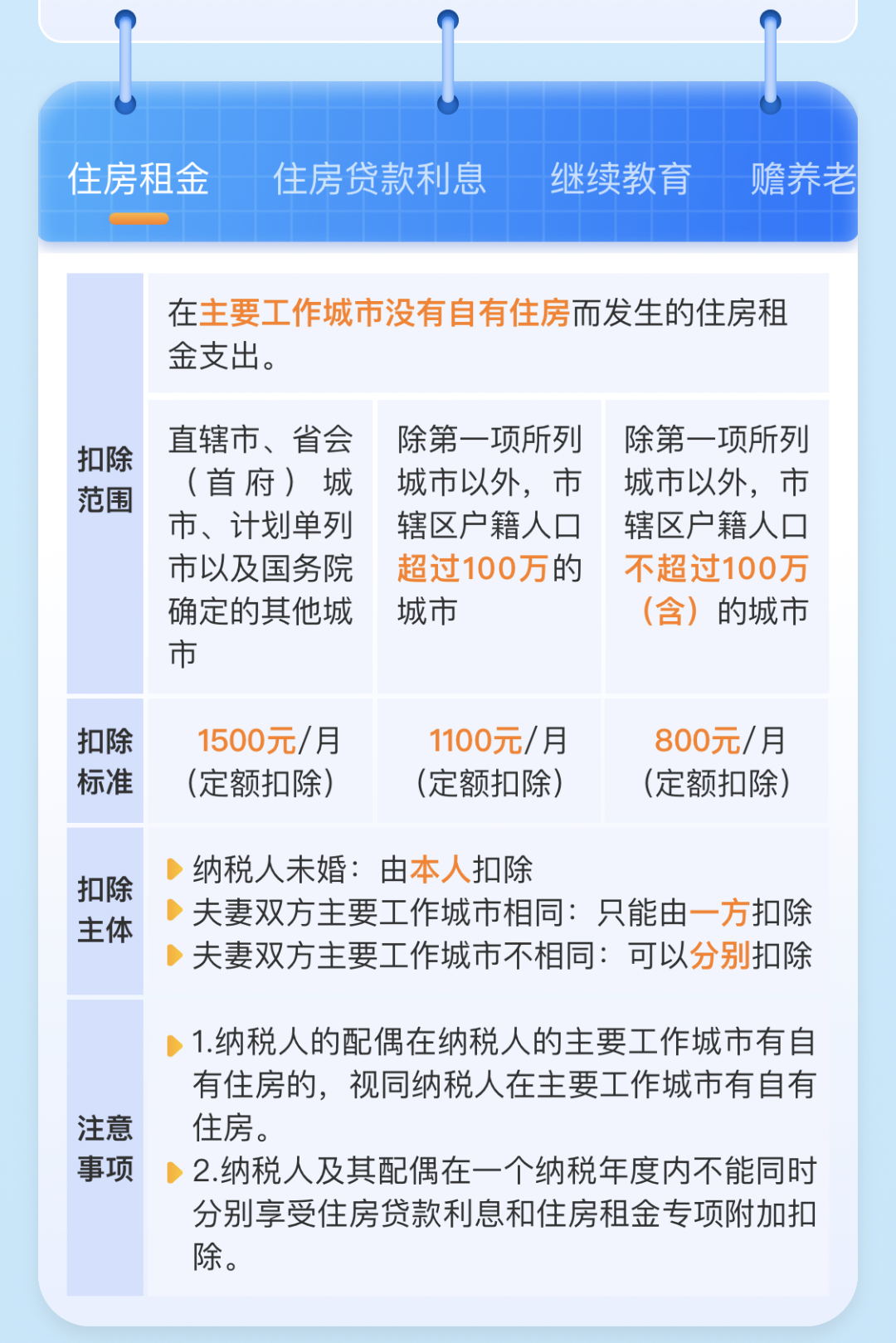

Housing rent

The housing rental expenses incurred by taxpayers without their own housing in the main working city can be deducted at a fixed amount according to the following standards:

For municipalities directly under the Central Government, provincial capitals (capital cities), cities with independent planning status, and other cities determined by The State Council, the deduction standard is 1,500 yuan per month.

In addition to the cities listed above, for cities with a registered population of over one million in their urban districts, the deduction standard is 1,100 yuan per month. In cities where the registered population of a district does not exceed 1 million, the deduction standard is 800 yuan per month.

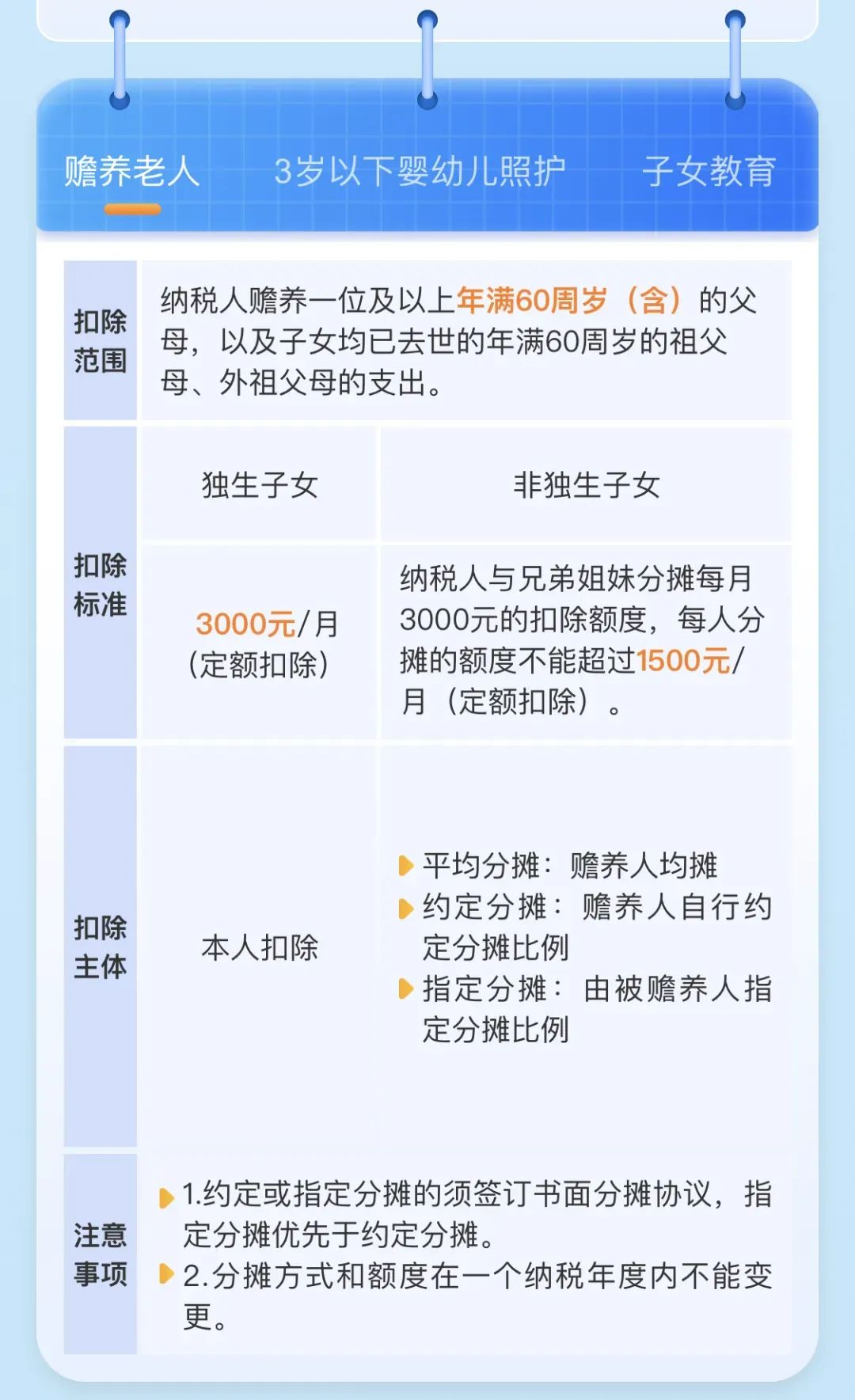

Support the elderly

For taxpayers who support one or more dependents, the support expenses shall be deducted at a fixed amount in accordance with the following standards: If the taxpayer is an only child, a fixed deduction of 3,000 yuan per month shall be made. If a taxpayer is not an only child, the deduction amount of 3,000 yuan per month shall be shared with his or her siblings, and each person's share shall not exceed 1,500 yuan per month.

Greeting for infants and toddlers under 3 years old

Taxpayers' expenses related to caring for children under the age of 3 shall be deducted at a fixed rate of 2,000 yuan per child per month.

Parents can choose to have one of them deduct 100% of the deduction standard, or both can choose to have each deduct 50% of the deduction standard. The specific deduction method cannot be changed within a tax year.

"Official confirmation!" Those with an annual income of less than 100,000 yuan basically do not pay individual income tax

Wang Dongwei, vice minister of Finance, said at a recent regular policy briefing of The State Council that currently, individuals with an annual income of less than 100,000 yuan basically do not pay or only pay a small amount of personal income tax.

After the standards for the three special additional deductions are raised, the tax burden on taxpayers will be further reduced, especially for the middle-income group, the tax reduction will be even greater.

How can one achieve the goal of "individuals with an annual income of less than 100,000 yuan basically not paying individual income tax"?

Regarding this issue, Wang Dongwei, the vice minister of Finance, stated:

Since The State Council announced on August 31, 2024 that it would raise the standards for three special additional deductions: supporting the elderly, caring for infants under three years old, and continuing education for children, the tax burden on taxpayers will be further reduced. In particular, the tax reduction for the middle-income group will be even greater. Our country has over 400 million middle-income groups, and this group will benefit the most.

For instance, if a taxpayer has two children and either his father or mother is over 60 years old, according to the new deduction standard, this taxpayer can deduct an additional 3,000 yuan each month, which amounts to an extra 36,000 yuan in a year.

If a taxpayer's annual income is 200,000 yuan, then his tax reduction rate will reach 54%.

If a taxpayer's annual income is 500,000 yuan, his tax reduction rate will reach 14%.

For example:

The individual resident has a pre-tax annual income of 100,000 yuan. The annual personal contribution to the three insurances and one fund is 10,000 yuan. There are two children in primary school and both parents are over 60 years old.

Assuming there is no other income throughout the year, the taxable income for individual income tax calculated by the formula =

100,000-60,000-10,000-2,000 ×2×12- 3,000 ×12= -54,000 yuan (that is, 0 yuan), and no personal income tax needs to be paid at all.

If there are other additional deductions such as interest expenses on housing loans, the taxable income will only be lower.

The above cases list the individual income tax situations of most families. However, if the taxpayer is not married, has no children, and their parents are under 60 years old, the situation may be slightly different.

The individual resident has a pre-tax annual income of 100,000 yuan, and the annual personal contribution to the three insurances and one fund is 10,000 yuan. They are unmarried, have no children, and their parents are under 60 years old. The only expense is housing rent. When there is no other income throughout the year: The taxable income for individual income tax = 100,000-60,000-10,000-1,500 ×12= 12,000 yuan. Tax payable

= 12,000 ×3%=360 yuan.